FILS in Barcelona: What will help traders best adapt to the new bond market?

Although the basic function of a trader – price and liquidity formation – has remained the same over the past two decades, the level...

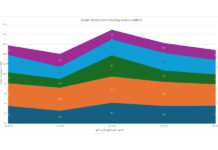

Emerging market bonds issuance and returns grow

This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With...

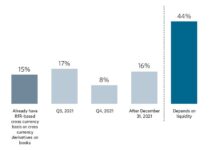

Bloomberg/PRMIA report finds liquidity barrier to RFR derivatives use

A new report by the Professional Risk Managers' International Association (PRMIA) and Bloomberg has found that while the majority (79%) of the firms with...

DirectBooks live with euro and sterling investment grade deals

Sell-side consortium DirectBooks, is now live with Euro and Sterling Investment Grade bond deal announcements on its bond issuance platform. The platform launched in...

Morgan Stanley an outlier as banks see FI trading revenues drop

In the third quarter of 2024, of five major banks – Citi, JP Morgan, Goldman Sachs, Bank of America and Morgan Stanley – only...

FILS 2024: “The key to delivering innovation”

Collaboration between humans and technology, between humans, and across businesses is essential to strengthening and developing fixed income markets in Europe, panellists at this...

LTX migrates corporate bond trading capabilities to AWS

LTX, a subsidiary of Broadridge Financial Solutions, has migrated its corporate bond e-trading platform to Amazon Web Services (AWS). With the completed migration, LTX...

MeTheMoneyShow : Dimon worries about fintechs

Dan Barnes, Editorial Director of Markets Media Europe and senior writer Shanny Basar discuss the latest shareholder 'letter' from Jamie Dimon, chairman and chief executive of...

US unbundling does not impose fiduciary execution rules on dealers

By Flora McFarlane.

US banks are able to unbundle trade execution and research payments without incurring fiduciary responsibility for trade execution. Following a lengthy process...

Subscriber

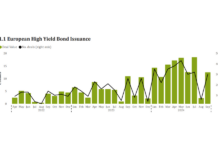

The Book: European HY issuance proceeds spike in Q3

European HY bond issuance year-to-date has generated €121.3 billion in proceeds, the second highest results in AFME’s records. The figure fell just below 2021’s...

EXCLUSIVE: TradingScreen bought by Francisco Partners

Execution management system (EMS) provider TradingScreen has been bought by private equity firm Francisco Partners for an undisclosed sum. The deal brings to a...

In 2021 we see record secondary markets trading for European Government Bonds

By Emile Figueiras, European Government Bond Product Specialist, MarketAxess

Secondary market volumes in European government bonds (EGBs) have grown significantly over the last 2 years....