FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

Europe avoids tariff panic, awaits US open as currency wobbles

Edging closer to US open, European and Asian markets are resisting panic, according to Eric Boess, global head of trading at Allianz GI.

“I was...

Private markets data deal reflects steady march to mainstream

UBS:

CIO Daily – Private markets data deal reflects steady march to mainstream

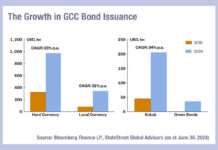

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

Citadel Securities trader leads USD rates at UBS

Kyriakos Manolis has joined UBS as head of USD rates trading for the EMEA region. He is based in London.

Foreign exchange, rates and credit...

Will the EC ban electronic bilateral bond trading?

The broadening definition of ‘multilateral’ is at risk of capturing all trading if traders do not speak out.

The European Securities and Markets Authority (ESMA)...

Investor demand: French no-confidence vote sharpens pressure on OAT-Bund spread

French Prime Minister François Bayrou’s call for a no confidence vote was scheduled for the 8 September late on Monday 25 August. Aiming to...

Rules & Ratings: Allianz SE maintains superior AM Best ratings

AM Best has affirmed Allianz SE’s financial strength and long-term issuer credit ratings as A+ (superior) and aa (superior).

The ratings account for both the...

WiseAlpha broadens bond access for retail

Retail investors can now access all UK corporate and government bonds through corporate bond investment platform WiseAlpha.

The company first issued fractional bonds in 2016,...

Pham replaces Behnam as CFTC chair

Caroline Pham has been named acting chairman of the Commodity Futures Trading Commission (CFTC), replacing Rostin Behnam.

Behnam announced his departure earlier this month, after...

On The DESK: What it takes to build a multi-asset trading team

Since becoming global head of trading at Schroders, Gregg Dalley has helped his teams become a single, multi-asset trading unit.

The DESK: What is your team’s...

The gaps that AI can close in credit markets

Artificial intelligence is being applied to bridge and unite information in bond trading. Liquidity is notoriously gappy in credit markets, and market data naturally...