TD Bank joins LTX as liquidity provider

TD Bank has joined AI-powered corporate bond trading platform LTX’s e-trading platform, via its subsidiary TD Securities Automated Trading.

TD Bank will contribute axes, or...

ICE: For asset owners, a better way to manage rate volatility

How sophisticated pricing & analytics can inform better risk management and asset allocation choices.

By Patrick Ge, CFA, Fixed Income Specialist, Product Management & Neil Patel,...

Market disruption spreads beyond Ukraine and Russia

Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering...

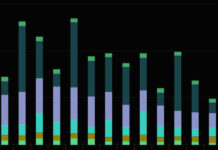

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

A tale of two metrics – US IG corporate bond market liquidity in 2022

By Julien Alexandre, 12 October 2022

Corporate Bond Market Distress Index

The NY Fed recently launched the Corporate Bond Market Distress Index and backfilled it all...

Systematic, hydromatic; can credit get as fast as greased lightning?

Some investment firms have claimed they can fully systematise credit trading by 2025, The DESK investigates.

Investment managers and banks are rapidly adopting systematic approaches...

valantic FSA to develop web UI for Nasdaq Rates Trader

valantic FSA has agreed to develop Nasdaq Rates Trader, a new web-based user interface for Nasdaq’s Nordic and Baltic fixed income markets.

The new UI...

Could buy-side share data?

Oscar Kenessey, head of derivatives, fixed income and currency trading at NNIP has suggested that sharing data between asset managers could help to overcome...

Beyond Liquidity: T+1 Testing Begins

DTCC, the US post-trade market infrastructure, formally started the testing program for moving to a shorter settlement cycle on 14 August so market participants...

FILS USA: The significance of portfolio trading breaking 10% volume

Record sized portfolio trades (PT) were reportedly responsible for pushing PT volumes up to around 10% of US credit market average daily volume in...

Enrico Bruni – The advantage of a diversified business

Enrico Bruni, managing director and head of Europe and Asia Business at Tradeweb, discusses the challenges posed by current market conditions.

How has the current...

Acuiti: Sell-side not confident on compulsory clearing timeline

Sell-side players are not confident in the introduction of clearing markets across cash Treasury and repo markets, concerned that deadlines are unfeasible, infrastructure is...