The liquidity gap between 144A and Reg S bonds

144A and Regulation S (Reg S) securities have distinct regulatory backgrounds and key differences. Liquidity measures such as Bid-Ask spread and post-issuance volumes in...

Gibson joins Ninety One as global head of trading

Cathy Gibson has joined asset manager Ninety One, an emerging market specialist with over £100 billion in assets under management, as global head of...

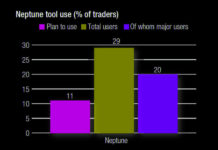

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

Subscriber

Quantitative Brokers: Rate futures market susceptible to shocks

A new paper by Quantitative Brokers’ research team, led by Shankar Narayanan has found that the average quote size of many interest rate futures...

CTP tender process delayed again

The FCA has again delayed its publication of consolidated tape provider (CTP) tender documents.

At the end of 2024, the authority stated that the documents...

TMPG: Better US Treasuries data needed for effective policy

The New York Federal Reserve’s Treasury Market Practices Group (TMPG) has published a white paper on ‘Data Availability and Transparency in the US Treasury...

Two thirds of bond issuers meet 2025 targets by June

Issuers are meeting their targets early this year as they get used to unpredictable markets, according to Mike Koerkemeier, global head of capital markets at...

UBS Execution Hub hires multiple senior buy-side traders as expansion continues

According to an internal memo, as seen by The DESK, Ian Power has joined UBS Execution Hub as head of UK execution, one of...

Research: ETFs worsen fixed income liquidity in a crisis

An academic paper has argued that fixed income exchange traded funds (ETFs) “improve bond liquidity in general, but worsen it in periods of large...

TransFICC: Establishing a clear path forward for the Consolidated Tape

Tim Whipman from TransFICC provides an update on the consolidated tape for European fixed income, and explains the key requirements, hot topics and technology...

Bloomberg machine learning pricing solution enhances fixed income trading visibility

Bloomberg’s Intraday BVAL (IBVAL) Front Office is now available to Bloomberg Terminal customers, as well as users of Bloomberg’s real-time streaming market data feed,...

OpenDoor launches all-to-all dark pool for on-the-run US Treasuries

OpenDoor Securities has launched an all-to-all marketplace for on-the-run (OTR) US Treasuries. The anonymous order book will US Treasury venue to offer non-discriminatory pricing in benchmarks...