LedgerEdge: Building low- and high-touch trading in a mutually inclusive model

Tailoring workflows within a distributed environment will allow traders to simultaneously optimise electronic execution and relationship-based trading.

FILS Daily: What effect have the increasingly volatile...

Calls on UK to issue first green sovereign bond with 10 to 12yr maturity...

A majority of investors and banks are calling on the UK government to issue its maiden sovereign green bond with a 10–12-year maturity next...

How Fed bond buying is impacting markets

The Federal Reserve Bank of New York is hoovering up assets in order to support corporate borrowing in the US, and subsequently creating some...

Russell Feldman named CEO of IMTC as it raises new funding

IMTC, a provider of fixed income investment management technology, has secured its first external funding round, which was led by Nyca Partners. This investment...

Burton-Taylor: S&P and IHS Markit merger creates intriguing synergies in data

On 30 November 2020, S&P Global and IHS Markit announced that they have entered into a definitive merger agreement to combine in an all-stock...

TransFICC: The increasing importance of data centres in fixed income

As the fixed income market becomes more electronic, we are seeing an increasing number of firms connecting to data centres around the world. The DESK...

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and...

Subscriber

Refinitiv report on fixed income trading finds strong appetite for automation

Refinitiv, part of the London Stock Exchange Group, and analyst firm Coalition Greenwich, have released a report on the evolution of trading in fixed...

Charlie Enright joins Symetra

Charlie Enright has joined insurance and retirement specialist, Symetra, as a credit trader.

Enright spent nearly seven years at Genworth, a similarly focused buy-side firm,...

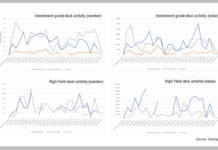

Aligning issuance and recession risk

Data from Dealogic is indicating highly variable bond issuance patterns in the US, European Union and UK markets, year-to-date.

This is understandable given the rapidly...

Europe’s government bond market hits electronic ceiling

Electronification of rates in Europe could significantly enhance liquidity and boost trading. David Wigan investigates.

Electronic trading of European government bonds may face a natural...

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...