Dan Burke joins MarketAxess

MarketAxess Holdings has appointed Dan Burke as global head of emerging markets. He reports to Raj Paranandi, chief operating officer for EMEA and APAC....

Intelligent application of artificial intelligence in credit

A picture has emerged of the future credit desk for buy-side traders, from discussions at the Fixed Income Leaders’ Summit in Washington DC last...

Amit Raja takes new role at Citi

Citigroup has confirmed that Amit Raja has been appointed regional head of markets for EMEA at the investment bank.

The announcement follows Leo Arduini’s appointment...

Do regulators understand ‘best execution’ in corporate bond markets?

What is best execution in bond markets?

In fixed income a best execution process matches up trade metrics to the investment parameters.

“Trading is simply how...

Who will be nominated for ‘Excellence in Leadership’ in 2024’s European Women in Finance...

Following a rollercoaster year of competition in capital markets, Markets Media is anticipating a bumper roster of nominees for ‘Excellence in Leadership’ in the...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Bloomberg, MarketAxess and Tradeweb Markets team up to tackle European consolidated tape

Bloomberg, MarketAxess and Tradeweb Markets today jointly issued the following statement:

“We are pleased to announce an initiative to jointly explore the delivery of a...

The big changes to watch in fixed income market structure through 2024

Next year will bring new developments in market structure, stemming both from regulatory and political change. The DESK asked Jennifer Keser, head of market...

This! Is! What! Liquidity! Looks! Like!

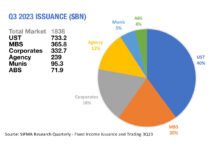

In the past quarter, the average daily notional traded for US Treasuries was 99.5% of the total value of securities issued in the same...

Getting the most out of derivatives in credit

Bond investing has become more exciting in the past two years than in the previous ten, with interest rates and central bank activity fire-fighting...

Allianz GI: On strength of voice

Effectively communicating across trading desks, teams, counterparties and industry is allowing Allianz Global Investors to stand out amongst asset managers. The DESK talks to...

Bondtape provides CT taxonomy to clarify definitions

Draft tender documents for the bond consolidated tape (CT) are expected by the end of the month, but there are still inconsistencies around market...