Fed breaks silence on HFT in treasuries

Having opened the US government debt market to high-frequency trading, authorities now push market participants to “be good citizens”. Dan Barnes reports.

The Federal Reserve...

It is EMS time for credit traders

The value proposition for execution management systems (EMSs) in fixed income markets has seen an about face in the past year. Buy-side firms who...

Michelle Neal: On taking great responsibility

Having managed the market divisions at several top-tier financial institutions, Michelle Neal is now responsible for supporting the most significant fixed income market in...

Turkey’s Fibabanka raises US$150m AT1 capital

Turkey’s Fibabanka has completed a US$150 million AT1 issuance, led by Citibank, Standard Chartered Bank as joint global coordinators and bookrunners and Emirates NBD...

Tradeweb steps into primary markets battle with InvestorAccess connection

Multi-asset market operator Tradeweb is collaborating with S&P Global Market Intelligence to introduce electronic connectivity between primary and secondary markets. The product scope currently...

UK sees first tokenised collateral FX transaction

Lloyds Banking Group and Aberdeen Investments have completed the first foreign exchange trade using tokenised collateral in the UK.

Tokenised units of Aberdeen Investment’s money...

KNG Securities appoints Edward Williams to emerging markets sales team

Fixed-income investment bank KNG Securities has appointed Edward Williams to its sales team as an emerging markets (EM) specialist.

Williams brings 30 years of experience...

Focus resources on fixed income TCA, industry urged

By Joel Clark.

Market participants and technology providers must focus their intelligence and resources on developing robust transaction cost analysis (TCA) for fixed income, in...

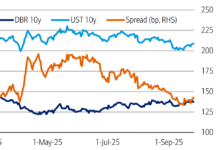

Investor demand: ECB has market pricing govies as if investors favour US over EU...

Market pricing since 21 May reads as if investors prefer US duration over euro-area duration: 10-year US Treasuries (UST) have rallied by 42 basis...

Asia close: Trading desks report tariff impact muted, US open tense

Following Asia market close, trading desks are reporting that the greatest impact from the US tariffs is expected to be seen upon market open...

Derivatives – Viable alternatives

Tougher capital and liquidity constraints for OTC assets are boosting exchange-traded products appeal to the buy side. Anna Reitman reports.

As trading over-the-counter (OTC) for fixed...

Sourcing and onboarding clean data remains major buyside challenge

Sourcing data that is cleaned, validated and ready to use from vendors remains a challenge for nearly 70% of fund managers in a new...