EXCLUSIVE: Citadel Securities confirms plans to enter corporate bond market

Citadel Securities has announced plans to enter the corporate bond market this year, The DESK can reveal, in a surprise play for one of...

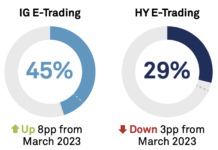

US high yield e-trading volumes drop YoY

US corporate bond activity saw a slight slowdown over March, although remained elevated on a historical basis, Coalition Greenwich’s April Data Spotlight on US...

LSEG restructures IT services

The London Stock Exchange Group (LSEG) has restructured its technology businesses under a single brand, LSEG Technology. The change took place over the summer...

MarketAxess muni offerings incorporated into Investortools Dealer Network

Fixed-income electronic trading platform MarketAxess has expanded its municipal bond integration with the Investortools’ platform, the latest phase of its Financial Information eXchange (FIX)...

Nomura Securities hit with special entitlements suspension

Nomura Securities has had its Special Entitlements of JGB Market Special Participants (Primary Dealer) suspended for a month as part of actions against unlawful...

Origination: Chevron issues US$5.5bn as revenue slumps

Chevron issued US$5.5 billion of notes in August after a disappointing second quarter.

The energy giant reported US$44.8 billion in revenues in Q2 2025, a...

Deutsche Bank fined, again

Deutsche Bank (DBK) is still falling foul of its past misconduct. The Comisión Nacional del Mercado de Valores (CNMV), Spain's National Securities Market Commission,...

Allianz GI: On strength of voice

Effectively communicating across trading desks, teams, counterparties and industry is allowing Allianz Global Investors to stand out amongst asset managers. The DESK talks to...

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

How banks slash the cost of managing market fragmentation

A smart application of hardware, cloud and open source technology makes for efficient trading systems. The complexity of the fixed income market should not...

US regulators battle to define bond market structure

US market regulator the Securities and Exchange Commission (SEC) has engaged in a series of initiatives that could collectively bring more structure and standardisation...

Boltzbit: The practical application of AI in investment and trading

Asset managers are already able to leverage large language models to boost investment and trading workflows.

The DESK spoke with Yichuan Zhang, chief executive officer...