Granit Funds hires Erlandsson as head of fixed income from AP4

Granit Funds has recruited Ulf Erlandsson as its head of fixed income starting in August. He comes from the Fourth Swedish National Pension Fund (AP4) where...

Technology: The real reason you cannot get a new trading system

Lynn Strongin Dodds investigates the barriers to adopting new technology.

Technological advances may be developing at breakneck speed but many of the barriers of adoption...

Greenwich: Data analytics now more valued than market structure knowledge

Three out of four capital markets professionals say data analysis will be the most valued skill on trading desks over the next five years,...

Glue42 to connect trading interface for Broadridge

Broadridge Financial Solutions will use Glue42, a software provider that delivers integrated desktop experiences to financial institutions globally, to help deliver a seamless trading...

ESMA lacks data to test bond market concerns

By Pia Hecher.

Regulators have acknowledged that bond market data is so sparse, even post-MiFID II, that they are unable to test execution quality concerns....

Coalition Greenwich: US Treasuries trading up 46% YoY in January

“The more the US government borrows (US$2.6 trillion in January), the more US Treasury traders trade.”

This activity, according to Coalition Greenwich’s Kevin McPartland, is...

Majdalani joins BNPP

Ray Majdalani has joined BNP Paribas as an emerging markets credit trader. He is based in London.

BNP Paribas reported €10 billion in net banking...

Investor demand: China’s US$759bn Treasury holdings hang by a thread as tariff war escalates

A continued sell-off in Treasury bonds, exacerbated after a notably poor 3-year auction on Tuesday, 8 April, has sparked widespread speculation among market participants....

AFME welcomes ESMA ‘call for evidence’ on shortening settlement cycles

In response to a ‘call for evidence’ on shortening settlement cycles in the European Union (EU), published by the European Securities and Markets Authority...

Eurex meets credit index futures demand with new products

Eurex has launched Bloomberg US Corporate Index Futures and Bloomberg US High Yield Very Liquid Index Futures, building out its global credit index futures...

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

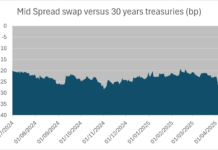

US rates take a summer dip

A slight cooling in average daily notional volumes (ADNV) in US rates trading, down 7% to US$1,012 billion from May’s US$1,097 billion, still represented...