Bitcoin, blockchain and the DLT chimera

The uncertain promises of distributed ledger technology for financial markets. By Ferdinando Ametrano, Banca IMI (Intesa Sanpaolo).

Distributed ledger technology (DLT) is at a very...

Bond platforms see leap in June volumes year-on-year

Trading platforms recorded double digit growth in average daily volumes (ADV) in June 2024. Tradeweb saw its June 2024 fully electronic US credit ADV...

HSBC Asset Management names Global Fixed Income CIO

HSBC Asset Management has appointed Michael Cross in the newly created role of Global Fixed Income CIO.

The fund manager said in a statement that...

Are US dealers still offsetting credit trading risks?

As US banks see credit positions turn negative, and interdealer market volumes remain flat, The DESK asks how they offset risk as their credit...

Connectivity platforms report FI deals ahead of MiFID II

By Sobia Hamid.

The growth of electronic trading in fixed income is driving connectivity between trading platforms. In 2016, Greenwich Associates estimated electronic trading of...

Citadel Securities FICC systematic trading head Mark Wilkinson departs firm

Citadel Securities’ head of FICC systematic trading Mark Wilkinson is to depart the firm.

According to a social media post, Wilkinson had his last day...

Securities Financing : India : Lynn Strongin Dodds

India’s lacklustre corporate bond market gets a boost.

Lynn Strongin Dodds looks at government initiatives and stock exchanges efforts to bring the market to life.

The...

Aligning the pre-trade credit liquidity picture and the execution goal

Pre-trade data and market colour are imperative for buy-side traders looking to achieve best execution in corporate bond markets. Understanding how that applies to...

Viewpoint: Lifting the pre-trade curtain

Michael Richter, an executive director at S&P Global Market Intelligence, and head of the Transaction Cost Analysis (TCA) business for EMEA explains the key...

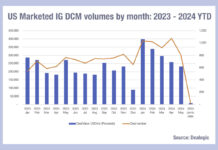

High Yield issuance is taking off

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

JP Morgan veteran poached by Old Orchard Capital Management

Jared Fand has joined New York-based investment management firm Old Orchard Capital Management as a trader, leaving JP Morgan after more than a decade...

Collins leaves Trumid for MarketAxess

Gav Collins has swapped Trumid for MarketAxess, being named head of the transformation office.

Based in London, Collins will work on the firm’s long-term strategic...