Franklin Templeton drops CRD cloud move in favour of Aladdin

Global investment management firm Franklin Templeton has selected BlackRock’s Aladdin order management system (OMS) to bring together its multi-asset class investment management platform.

The move...

Camille McKelvey: Time to turn things on their heads

Shanny Basar spoke to Camille McKelvey, Head of Post Trade STP Business Development at MarketAxess, about languages, diversity in the workplace and career paths.

She...

CME Group proposes date for fallbacks conversion of Eurodollar futures and options contracts

Market operator CME Group is proposing to convert Eurodollar futures and options open interest into corresponding secured overnight financing rate (SOFR) contracts on 14...

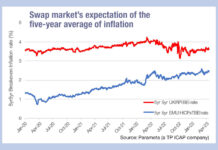

The UK’s inflation-linked notes getting snapped up

Data from Parameta, the TP ICAP company data and analytics provider, shows the five-year breakeven inflation rate for the UK, which represents a measure...

ESMA’s Active Account Requirements proposals rebuked by FIA and ISDA

The futures industry association (FIA) as well as the international swap dealers association (ISDA) have published their concerns about the added burden and impact...

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

Mike O’Brien made co-director global income at Eaton Vance

Michael O’Brien has been promoted to co-director global income at Eaton Vance, from his role as director of global trading, which he held since...

Emerging market bonds issuance and returns grow

This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With...

Stephen Grady joins Lombard Odier Group

Trading veteran, Stephen Grady, has been named head of global markets and executive vice president at Lombard Odier Group, the Swiss private banking firm,...

Veiner switches to head of markets at BlackRock

Dan Veiner has been promoted to head of markets at BlackRock Global Markets and Index investments (BGM).

The business combines BlackRock’s market-facing functions with the...

Criticism of price formation in Gilt syndication defended by UK’s Debt Management Office

Challenges to the process of UK government bond (Gilt) pricing by syndicate banks, made by member of parliament, Mel Stride, chair of the Treasury...

European Women in Finance : Alexandra Boyle : Making a noise

Alexandra Boyle, Head of Client Strategic Group at OpenFin, speaks to Markets Media’s senior writer Shanny Basar about her career, her philosophy and her...