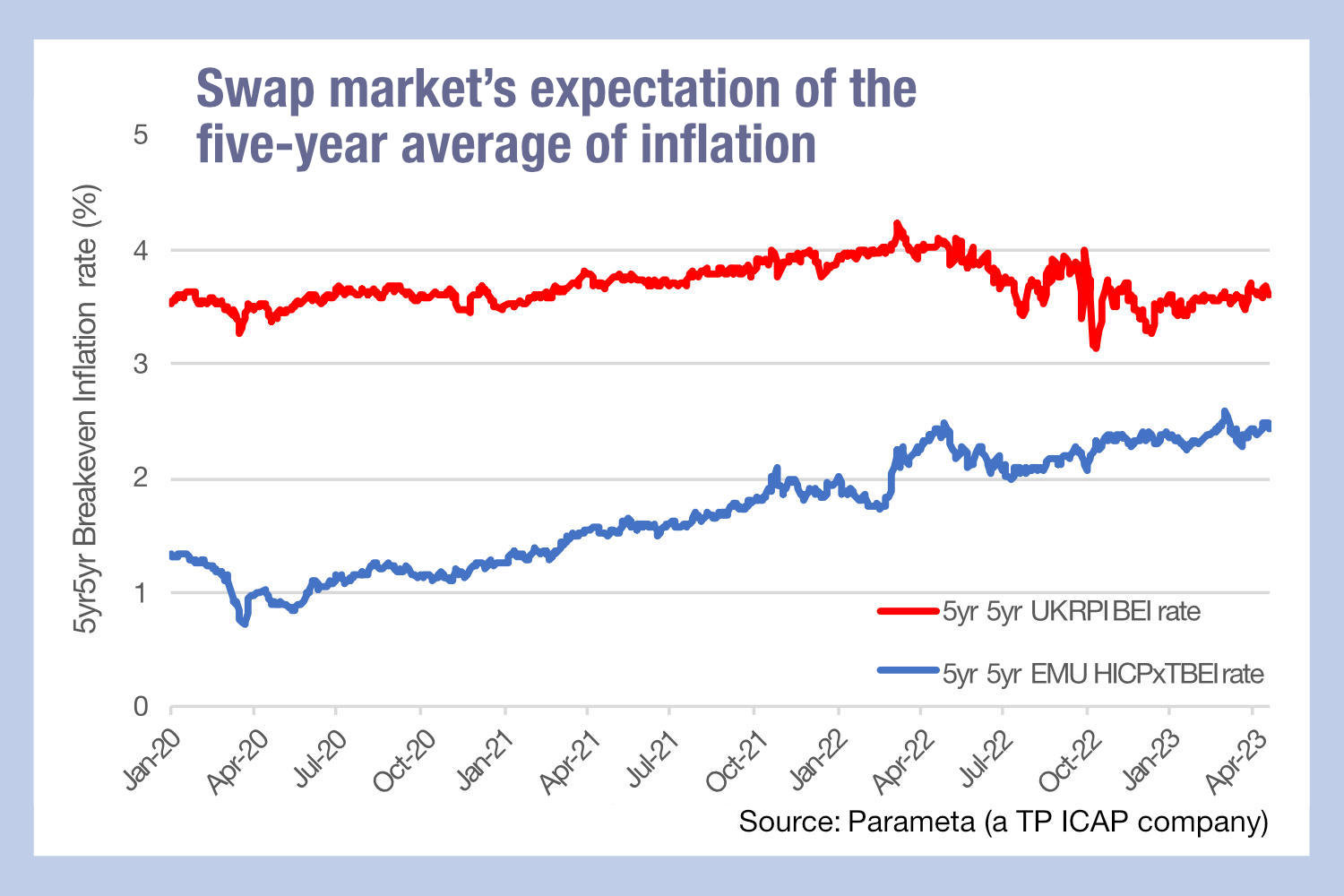

Data from Parameta, the TP ICAP company data and analytics provider, shows the five-year breakeven inflation rate for the UK, which represents a measure of expected inflation derived from five year inflation swaps, is stable or event climbing in the 3.5-4% range, above that of the US or EU.

The firm has observed that a recent £4.5 billion issuance of a 2045 note put out by the UK was oversubscribed by ten times, indicating confidence amongst investors that these securities will be delivering strong returns.

The implications of this are interesting for bond investors and traders. Continued inflation over a five-year-period will make the case for higher Bank of England rates. That will make debt more costly for issuers and a better yield for investors, however, with greater competition for higher quality paper.

Secondary credit markets are awash with older debt carrying relatively lower coupons, and for some firms whose economics may be severely challenged in a higher inflationary environment.

European and US interest rates have the potential – based on market expectations and some inflation measures – to stay lower, and fall sooner, with the subsequent possibility of making debt more popular with issuers in those regions than in the UK, but with UK debt markets looking more attractive to investors.

©Markets Media Europe 2023