Baillie Gifford bond fund changes name and cuts fees by 50%

In January 2021, the Baillie Gifford Worldwide Global Credit Fund became the Baillie Gifford Worldwide Global Strategic Bond Fund. In addition, Baillie Gifford cut...

Nasdaq reports seven-year error in closing auction

Story updated 16.00 BST 30/8/18

In a Trader Alert published at 08.30 ET, on 30 August 2018, updating a previous notice published on Friday 24...

Samy Ben Aoun to run continental-Europe rates at Barclays

Barclays investment bank has hired Samy Ben Aoun as head of rates trading for continental Europe, returning him to the firm’s trading floors nearly...

European Women in Finance: Isabelle Girolami – A fresh attitude to risk

Isabelle Girolami has been CEO of LCH Ltd. since 1 November 2019. She has since had to deal with a global pandemic requiring employees...

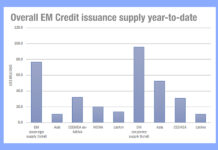

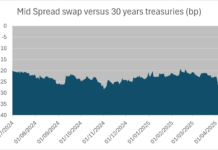

Issuance and inflows paint more positive picture for EM liquidity

Over the past week emerging markets (EM) credit issuance saw US$7.6 billion in newly issued bonds, against US£900k the week before, while on the...

BMLL marks move into fixed income with Level 3 futures data

BMLL, a provider of historical Level 3 data and analytics, has expanded its product offering to include global futures, now available as asset class...

Investor demand: China’s US$759bn Treasury holdings hang by a thread as tariff war escalates

A continued sell-off in Treasury bonds, exacerbated after a notably poor 3-year auction on Tuesday, 8 April, has sparked widespread speculation among market participants....

Tradeweb talks up futures market; reports Q1 growth, LSEG confusion

Tradeweb, a subsidiary of London Stock Exchange Group (LSEG), saw continued outperformance in fixed income markets in the first quarter (Q1) of 2024.

Tradeweb’s...

Mike Rosborough, CalPERS: On truth and transparency

Dating back to the 1930s, the California Public Employees Retirement System (CalPERS) is the largest pension fund in the United States. Mike Rosborough, senior portfolio...

Institutional sales trader veteran James Williams moves to Tourmaline Europe

Institutional sales trader veteran James Williams has been made managing director of outsourced trading solutions firm Tourmaline Europe, based out of London.

Williams has spent...

Asset managers offering lower discount to promote new bond fund launches than equity funds

The launch of 'early-bird' share classes by asset managers is no longer uncommon in Europe according to research firm Fitz Partners, which now tracks...

Helen Burgess joins S&P Global

S&P Global has appointed Helen Burgess as sales director for the market intelligence division.

Burgess has close to three decades of industry experience, most recently...