Virtu, InvestorLink partner to enhance retail broker primary market access

Virtu Financial and InvestorLink have partnered to offer underwriters access to Virtu’s network of retail broker-dealers and enhance access to secondary market liquidity.

InvestorLink will...

Industry viewpoint : Mike du Plessis : UBS

COMING TO TERMS WITH THE NEXT PHASE OF MARKET TRANSFORMATION.

By Mike du Plessis, Managing Director, UBS Global Head of FX, Rates & Credit Execution...

FILS in Barcelona: Should you be switching from high yield bonds to leveraged loans?

Thierry De Vergnes, managing director of acquisition debt funds at Amundi, presented a compelling case at FILS 2023 for why high yield loans are...

Derivatives Service Bureau launches Unique Product Identifier service

The Derivatives Service Bureau (DSB), a global source of reference data for over-the-counter (OTC) derivatives, has launched the Unique Product Identifier (UPI) Service, enabling...

First rise in sell-side FICC revenues for five years

The first quarter of 2017 saw a recovery in dealer revenues in fixed income, currencies and commodities, rising 19% against Q1 2016 revenues according...

Changing with the times

By Paul Reynolds, CEO of Bondcube

For a long time I have thought that the bond market shares many dynamics with the grocery industry. Large,...

Securities financing: SFTR threatens smaller players

By Lynn Strongin Dodds.

The delay to the regulation gives market participants more breathing room but they should not get too comfortable. Lynn Strongin Dodds looks...

The breakdown: How asset managers are tackling fixed income unbundling

By Flora McFarlane & Dan Barnes.

With the revised Markets in Financial Instruments Directive (MiFID II) set to arrive in just under five months, buy-side...

Credit trading desks seeing job cuts & hiring freezes, adding to operational pressure

Reports of reduction in headcount on buy-side trading desks at BlackRock, Nuveen and Wellington with cuts also reported at investment banks, are demonstrating the...

Lombard Odier taps Neptune Networks for real-time axe data

Geneva-based Bank Lombard Odier has partnered with fixed income network Neptune Networks to offer its traders and advisers real-time axe data.

Lombard Odier clients can...

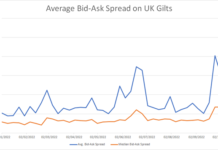

Barnes on Bonds: Secondary Gilt Trip

To look at the whipsaw effect of the UK’s 23 September mini-budget on secondary UK bond trading, we have taken data from MarketAxess TraX,...

Viewpoint : Best execution : Constantinos Antoniades & Rebecca Healey

A global gold standard of best execution – moving beyond MiFID II

By Constantinos Antoniades, Head of Fixed Income, and Rebecca Healey, Head of EMEA...