Iress, Ediphy rollout fixed income trading solution

Iress has partnered with Ediphy to offer Iress trading customers access to a low-cost mechanism to trade fixed income and the ability to source...

BondbloX to offer US corporate, muni and Treasury bond liquidity

BondbloX Bond Exchange (BBX), the world’s first fractional bond exchange, has integrated with ICE Bonds to offer US corporate, municipal and treasury bond liquidity...

State Street introduces buy-side to buy-side repo programme

State Street has launched a new peer-to-peer repo programme for the buy side. Building out from its sponsored repo and securities lending model, including...

Stephanie Bopp returns to Janus Henderson

Janus Henderson has rehired Bopp as a trader in Denver. She joins from Empower, the investment and retirement solution provider, where she was a...

This Week from Trader TV: Baillie Gifford: Tackling the complexities of cross-asset trading costs

Measuring cross-asset transaction cost analysis (TCA) and trade performance still faces major constraints, says Baillie Gifford’s Petros Kyliakoudis, with unique nuances and complexities across...

Insights & Analysis: “Underestimated” US economy headed for soft landing

The US economy is on track for a soft landing, according to State Street Global Advisors – but “there are undoubtedly a variety of...

The rapid rise – and risks – of EM e-trading for dealers

Dealers are competing fiercely to support clients in emerging market bonds, jumping between optimal electronic execution methods and developing nascent trading algorithms themselves where...

RBC joins ICE Clear Credit

RBC Capital Markets has joined Intercontinental Exchange (ICE) Clear Credit as a futures commission merchant (FCM). RBC becomes the first FCM participant at ICE...

Bloomberg Indices capitalises on growing leveraged loan market

Bloomberg has expanded its leveraged loan indices to both European and global markets, building on growth in the European market and increased client demand.

Jasvinder...

Morgan Stanley: Fed buying programme has benefits beyond direct purchases

Analysis of the Federal Reserve’s Secondary Market Corporate Credit Facility (SMCCF) by Morgan Stanley analysts has found that its purchases of exchange traded funds...

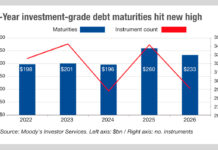

Trouble ahead for traders as number of issued bonds climbs

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given...

US electronic platforms’ credit activity plateaued in July

Tradeweb now narrowly leads over MarketAxess in fully electronic US IG+HY trading, Trumid said it continues to gain market share.

Average daily volume reported on...