Ex-RBC director joins ItauBBA emerging markets team

Conor Hails has joined the emerging markets rates and foreign exchange sales team at ItauBBA. He is based in New York.

ItauBBA, part of the...

Cash is king: investors seek refuge in USD

Institutional investors are clamouring for cash as they exercise caution around equities and fixed income over wider macroeconomic uncertainties, according to State Street Holdings...

SEC pushes for transparency of municipal bond issuers

By Pia Hecher.

US market regulator the Securities and Exchange Commission (SEC) amended its Securities Exchange Act on 20 August 2018, to enhance disclosure of...

Santander, Ramirez & Co. and Mischler Financial Group join DirectBooks

DirectBooks has had Santander, Ramirez & Co. and Mischler Financial Group join its bond issuance platform.

The three additions bring the total number of underwriters...

Loyer promoted at AXA IM

Yannig Loyer has been named global head of trading, securities financing and derivatives at AXA Investment Managers (AXA IM). He was appointed ahead of...

Potential SEC pilot programmes explored by new bond committee

The Securities and Exchange Commission’s Fixed Income Market Structure Advisory Committee (FIMSAC) explored the possibility of prescriptive intervention to accelerate bond market structure and...

Eurex launches EU bond futures

Eurex will offer futures on European Commission-issued EU bonds from 10 September.

The EU bond futures (FBEU) will be physically deliverable contracts with a 6%...

Bond issuance platform eppf signs deal with DZ Bank

European bond issuance platform, european primary placement facility (eppf), has signed a new cooperation agreement with DZ Bank. eppf’s bond issuance platform will now...

Technology: Can the EMS become a desktop trading venue?

Direct streaming of dealer prices could allow traders to bypass third party venues, if their desktop systems can be used to execute direct streams...

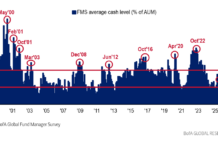

Investor Demand: BofA sees investor sentiment bounce back in May

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In...

IMTC launches new, streamlined platform

Fixed income technology specialist, IMTC, has launched a new and improved platform designed to enable fixed income investment managers to improve the accuracy and...

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...