FTSE Russell weighs country accessibility for fixed income traders

FTSE Russell, the index and data firm, is introducing a country classification process for fixed income. The newly introduced fixed income framework, which is...

Christian Laloe joins KNG Securities to support Latin American growth

KNG Securities, the fixed income investment banking boutique, has appointed Latin American (LatAm) specialist Christian Laloe as head of debt capital markets and special...

Adaptive names Dave Clack as chief product officer

Adaptive Financial Consulting has named Dave Clack as chief product officer, a newly created role as the firm looks to focus on its infrastructure...

Chinese govies step closer to collateral acceptability

Acceptance of Chinese government bonds as collateral will hinge upon rule changes around defaults. Lynn Strongin Dodds reports.

The use of Chinese government bonds as...

European trading strained in high yield

Comparing European high yield (HY) and investment grade (IG) corporate bond data from MarketAxess, the pressure for traders and investors in high yield markets...

JP Morgan cleaned up in Q4 2023 fixed income trading

JP Morgan’s fixed income markets revenue for fourth quarter 2023 were US$4 billion, up 8% YoY, driven by higher revenue in the securitised products...

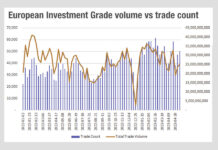

The implication of Europe’s falling volumes

An ominous sign in Europe’s secondary markets for dealers, as volumes remain in the doldrums.

Anecdotally, buy-side firms report volumes are up to 20%...

Tipping Point: CME’s SOFR-linked STIR Futures eclipse Libor-linked STIR Futures for first time

CME open interest data confirms that Secured Overnight Financing Rate (SOFR)-linked short term interest rate (STIR) Futures open interest has, for the first time,...

Horan: Buy-side trader role and support will continue to change in 2021

By Michael Horan, Head of Trading, EMEA, at BNY Mellon’s Pershing.

Today, buy-side firms have to grapple with the most complex trading environment in the...

MeTheMoneyShow – Episode 15

This week, Dan Barnes speaks with Global Trading's Shanny Basar about fixed income ETFs. In these uncertain times, why are they proving so popular (in...

Research: ETFs worsen fixed income liquidity in a crisis

An academic paper has argued that fixed income exchange traded funds (ETFs) “improve bond liquidity in general, but worsen it in periods of large...

MiFID II are you ready for 2018?

With the introduction of MiFID II and MiFIR on 3 January 2018, the European financial markets will face the biggest regulatory change they have...