Shielding from exploding issuance

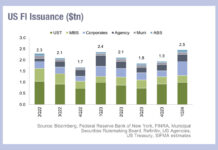

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase...

Liquidnet reports ‘record’ $3.5bn volumes in Q1 2024

Liquidnet saw “record” trading volumes through its New Issue Trading (NIT) protocol, reaching US$3.5 billion, more than double the previous quarter.

The firm also saw...

Joel Kim of Dimensional Fund Advisors on corporate bond liquidity

With Joel Kim, Head of International Fixed Income and CEO Asia ex-Japan, Dimensional Fund Advisors.

Briefly describe Dimensional Fund Advisors, including its fixed income trading...

Arnaud Bouyer to join Barclays from GBL

Barclays has appointed Arnaud Bouyer as head of investment banking for France BeLux, effective September.

Taking overall responsibility for the French investment banking business, Bouyer...

How the Trumid takeover will affect Electronifie traders

All-to-all US bond trading platform Trumid has agreed to buy fellow all-to-all trading platform Electronifie. Upon closing, the deal will mean the Trumid user...

SEC committee proposes bond issuance database for US credit

By Pia Hecher.

The Securities and Exchange Commission (SEC) Fixed Income Market Structure Advisory Committee (FIMSAC) has proposed that the SEC establish a new issue...

CurveGlobal saw 194% volume rise YoY in February

By Pia Hecher.

CurveGlobal has claimed a record start to 2019, with monthly average trading up 194% in February over the same month in 2017....

FILS USA: Policy, predictions and reasons for optimism

While outlooks are often gloomy, speakers at this year’s Fixed Income Leaders Summit were optimistic about the future of the industry. That said, the...

Tradeweb sees August ADV jump 53.9%, MarketAxess up 39.6%

Trading platforms MarketAxess, Tradeweb and Trumid saw substantial increases in their average daily volumes for August compared to the same period last year. MarketAxess...

Secondary volumes in 2021 outpace 2020 sell-off implying greater liquidity

The first quarter of 2021 saw record volume in US and European investment grade trading volume. This is surprising on several fronts, with significant...

Buy side challenges SEC liquidity proposals

A number of buy-side firms have challenged Securities and Exchange Commission (SEC) proposals that would require open-ended mutual funds, excluding money market funds and...

ISDA expands transparency exercise to European CDS

The International Swaps and Derivatives Association (ISDA) has expanded its SwapsInfo derivatives database to include European credit default swaps (CDS) trading activity, enhancing transparency...