Fitz Partners: Fund revenue margins drop 10% in 3 years, multi-asset offers hope

In the latest edition of its ‘Investment Advisory Fee Benchmarking Report’, fund research company Fitz Partners has looked at the different costs which make...

ICE Data Services: Bond defaults double in Q2

ICE Data Services has seen the level of defaults for bonds double in Q2 2019 to US$7.183 billion, up from US$2.616 billion in Q1...

AxeTrading and Mosaic Smart Data collaborate on bond market analytics

AxeTrading, the fixed income trading software provider, and Mosaic Smart Data, the real-time capital markets data analytics company, are integrating the AxeTrader execution management...

Tradeweb joins forces with Boerse Stuttgart, sees Q2 revenues up 19%

Market operator Tradeweb is partnering with Boerse Stuttgart to offer the German exchange’s users direct access to liquidity in US bond trading. The exchange...

Hermes Investment Management chooses IHS Markit for TCA

By Flora McFarlane.

Hermes Investment Management has chosen IHS Markit’s TCA platform ahead of incoming best execution obligations under MiFID II.

The technology provider’s TCA platform...

On The Desk: Juan Landazabal: On trader evolution

Juan Landazabal, global head of Fixed Income and Foreign Exchange Trading at Deutsche Asset Management describes the internal and external pressures that are shaping the...

Platforms: What the winners are doing right

A few platforms have consistently gained buy-side confidence over the last five years, through smart assistance and simplification of trading workflow.

The three ‘O’s of...

J.P. Morgan: Survey reveals specific growth opportunities for electronic trading

Expectations of volatility jump as traders across the market seek liquidity and cost management through single dealer platforms.

J.P Morgan’s annual E-trading Edit, a comprehensive...

Clearstream consortium seeks to resolve historic Reg S and Rule 144A bond inefficiencies

In October, the international central securities depositary (ICSD), Clearstream, has its seventh meeting of its business consortium to reduce operational risks and time delays...

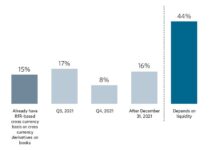

Bloomberg/PRMIA report finds liquidity barrier to RFR derivatives use

A new report by the Professional Risk Managers' International Association (PRMIA) and Bloomberg has found that while the majority (79%) of the firms with...

Amy Koch Flynn named head of trading for strategic advisors at Fidelity

Fidelity Investments has appointed Amy Koch Flynn as head of trading for strategic advisors. She is based in Boston.

Koch Flynn has more than 25...

EXCLUSIVE: Citadel Securities confirms plans to enter corporate bond market

Citadel Securities has announced plans to enter the corporate bond market this year, The DESK can reveal, in a surprise play for one of...