Last year, Jane Street and Jump Trading had their rating outlooks upgraded by ratings agencies, as they overcame potential hurdles facing their businesses. Electronic market makers like these represent an alternative to banks for buy-side trading desks, and their support for liquidity in debt markets is reportedly often outstanding, both in listed derivatives, swaps, several government bond markets and corporate bonds.

“Fitch’s sector outlook for interdealer brokers and market makers, including high frequency traders, such as publicly rated Jane Street Group LLC (‘BB+’/Positive); Hudson River Trading LLC (‘BB’/Stable) and Virtu Financial LLC (‘BB-‘/Stable) remains Neutral,” says Ben Schmidt, senior director for Non-Bank Financial Institutions, at Fitch. “This reflects the nature of their business model, which benefits from increased market volatility, such as the market activity spurred by recent changes in US trade policies in April 2025, through increased trade volumes and higher trading revenues.”

Over-the-counter (OTC) markets are a challenge for market makers of any type, as they require greater warehousing of risk. Like banks, electronic liquidity providers (ELPs) or high frequency traders (HFTs) need to manage their capital in order to help manage their risk exposure.

Depending upon the instruments traded, these can include credit risk, currency risk, liquidity risk, leverage risk, market risk and off-balance sheet risk.

For counterparties, understanding the risk profile of these privately held firms is useful. Not only does it create a level of strategic confidence in consistent liquidity provision, it builds a picture of their business models and approach to risk transfer.

Although ELPs are not subject to the same public disclosures or risk-capital requirements as banks, when they are onboarded by buy-side firms as counterparties they are subjected to the same risk tests as banks and other firms. These typically include balance sheet and income statements, which may be held within the counterparty onboarding team, rather than seen by traders.

From a disclosure perspective, ELPs registered as broker dealers in the US are subject to the Uniform Net Capital Rule 15c3-1 of the Securities and Exchange Commission (SEC), a 1975 piece of regulation.

Designed to ensure they have ethe capital needed to protect customers and creditors from losses, the rule requires navigation via a complex set of guidance and calculations, based on a multiplicity of factors and caveats, and is indicative of risk levels within a business.

Net capital

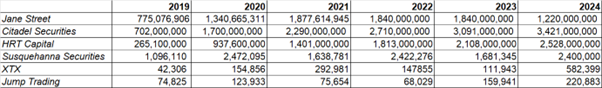

Holdings can range from billions to just hundreds of thousands of dollars. The different levels of net capital they are required to hold reflect that fact that despite fitting the ELP/HFT category, each firm is a very different beast. They can also change dramatically as a firm elects to hold more capital to balance risk.

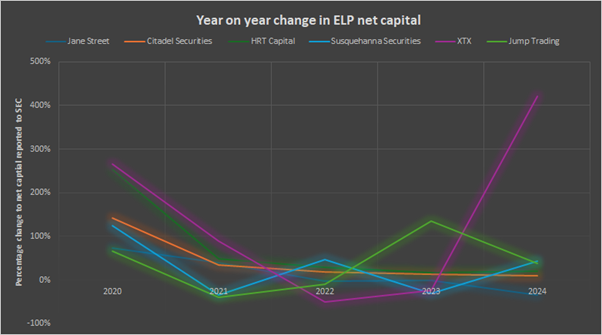

This is seen most clearly in 2020, when market volatility coincided with year-on-year (YoY) net capital increases of 266% at XTX, 142% at Citadel Securities and 126% at Susquehanna Securities.

Those proportional changes mask very materially levels of capital that are held.

Citadel Securities, Hudson River Trading (HRT) Financial and Jane Street use the alternative standard permitted by the rule, as market makers, requiring that net capital be at minimum the greater of US$1 million or 2% of aggregate debit items.

As of 31 December 2024, Citadel Securities’ net capital was US$3.42 billion in excess of the company’s reported required minimum net capital of $1 million, up from US$2.29 billion in 2021. Jane Street reported as of the same date that it had net capital of US$1.22 billion, exceeding its reported requirement of US$1 million. Hudson River Financial had net capital of $2.5 billion at that point.

Susquehanna Securities had US$2.4 million of net capital as of 31 December 2024, noting it is required to maintain an amount determinable based on the market price and number of securities in which it is a market-maker, not to exceed $1,000.

XTX and Optiver both elect to use an alternative method permitted by the rule, which they note in filings requires them maintain net capital equal to the greater of US$250 or 2% of aggregate debit balances, with XTX reporting it had US$528,399 of total capital and Optiver holding net capital of US$540,093 both exceeding their reported net capital minimum’s of US$250.

Jump Trading’s method reportedly requires it to maintain no more than $1,000 unless required by SEA Rule 15c3-1(a), and it held US$220,883 at the end of last year easily exceeding that amount.

Rating their debt capital

Another measure of risk profile can be gleaned by their ratings and rating outlooks, awarded by firms such as Fitch, Moody’s and S&P, and in the bond issuance notes themselves.

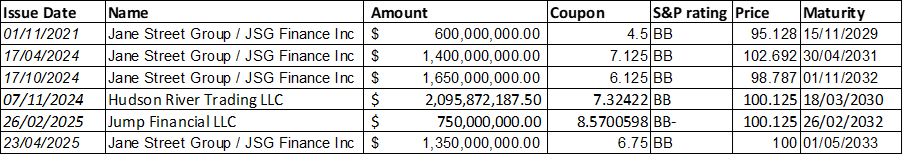

Some HFTs use debt markets to support their capital positions, requiring an assessment by rating agencies.

Source: Bloomberg, bond issuance documents, The DESK,

In April 2025 Jane Street issued a US$1.35 billion senior secured note, due 2033, priced at 6.75%. This is part of a US$5.4 billion net debt issuance with noted due in 2029, 2031 and 2032, and is dwarfed by the firm’s near US$30 billion of partner equity.

Within its bond issuance document, Jane Street noted that it held a liquidity buffer of 15% of total traded capital.

Ratings agency, Fitch rates Jane Street as BB+ Long-Term Issuer Default Rating reflecting its strong, position as a market maker in the exchange-traded fund (ETF) market, and track record of managing market and operational risks. It notes this governance is helped by the high level of member ownership and that member withdrawals are expected to “remain reasonable”.

“Jane Street’s tangible capital base has significantly increased over the last four years, and the growth has provided a more meaningful buffer against potential operational losses,” the firm writes.

Last year, S&P Ratings noted that Jane Street had substantively diversified its activities from exchange traded fund market making, over the last few years, become a highly profitable market maker for multiple asset classes and revised its outlook on issuer credit rating to ‘Positive’ from ‘Stable’.

“The positive outlook reflects the possibility that we could raise the ratings in the next 12-18 months if the company sustains benefits from its enhanced scale and increased diversification, while also maintaining the improvements in its funding profile and its strong capital position,” wrote analysts Thierry Grunspan and Robert Hoban.

Jump Financial issued US$750 million of debt in February having had its outlook revised by S&P Global Ratings last year to stable, from negative, and affirming the ‘BB-‘ issuer credit and senior secured debt ratings, with an assumption that the firm would maintain its risk-adjusted capital (RAC) ratio above 10%.

“We revised the outlook to stable because we believe the implementation of Jump’s enhanced VaR framework reduces uncertainty about the trajectory of its RAC ratio,” wrote lead analyst Prateek Nanda, and Hoban. “The company has completed the integration of the remaining asset classes into its enhanced VaR, with VaR now encompassing 99% of trading book positions. And with Jump’s expansion into slightly longer-duration strategies–which includes holding more positions overnight–the company’s risk is now better reflected in its end-of-day reported VaR. Despite these inclusions, we have not seen a material increase in the reported VaR or its volatility.”

Hudson River issued US$2.35 billion of senior secured term loan B due 2030 in November 2024, reportedly to repay an existing $2.1 billion term bank loan maturing in 2028, and to support the expansion of HRT’s trading business and liquidity.

“Despite recent considerable growth in its balance sheet, we expect HRT’s pro forma RAC ratio to remain well above 10% with the upsized debt versus 14.8% as of June 30, 2024, largely owing to strong earnings and retention,” the analysts wrote. “The positive outlook on the long-term issuer credit rating indicates our expectation that HRT will maintain supportive liquidity, capitalization, and operational performance as it continues to expand its trading operations and manage risk.”

Citadel Securities has no public bond curve and has issued a US$4 billion Term Loan B maturing in October 2031, based on upsizing of existing debt offerings, including a US$400 million upsizing in 2022, at S+200bps.

“We view capitalization as strong, given that we expect the risk-adjusted capital ratio to remain above 11%,” wrote S&P’s analysts last year. “Through earnings retention equity capital has grown to US$9.9 billion as of 30 June 2024, which supported a risk-adjusted capital (RAC) ratio of more than 18%. We expect distributions to owners in the second half of the year, coupled with continued trading growth, will lower the RAC ratio, but expect it will remain above 14% at year-end 2024. This still provides a good cushion against our downside threshold of 11%. While earnings can be volatile due to a reliance on principal trading, we view favourably the firm’s history of posting operating performance across market cycles.”

More resilient risk management

By most measures ELPs seem to be proving effective at making markets even in volatile periods – contrary to some expectations. Although they themselves note that risk measures such as S&P Global Ratings risk-adjusted capital (RAC) ratio, were really designed to measure bank risk not ELP risk, they are meeting these metrics favourably at present.

“Liquidity across the sector remains sound, with some issuers even increasing their liquidity buffers as a precaution against potential counterparty liquidity constraints,” notes Schmidt. “Fitch views risk control frameworks to be appropriately sophisticated and scaled, as evidenced by the absence of any notable operating systems availability issues during periods of recent heightened trade activity. Capitalisation is generally commensurate with the business model, with increasing capital buffers supported by solid internal capital generation. Regulatory developments, particularly in the US, are a watch item, notably as the new administration’s stance towards electronic market makers evolves.”

Buy-side traders note that the central risk books used by larger firms such as Jane Street and Citadel Securities, and model of internalising as much flow as possible to net off risk and minimise transaction fees, is being replicated by banks keen to emulate.

There are areas that ELPs will struggle to get into when competing with banks, such as interest rate swaps, but for liquid markets their counterparties and third party rating firms clearly believe they have the staying power to diversify and grow.

“I believe that they’re building their businesses bit-by-bit and properly, rather than rushing it,” notes one buy-side trader.

©Markets Media Europe 2025