By Colm Murtagh, Head of U.S. Institutional Rates, Tradeweb.

There are (surely) more obviously thrilling ways to celebrate a new year, but in many ways, the market transition from LIBOR to SOFR on December 31 made for a satisfying countdown into 2022. With LIBOR now discontinued for Sterling, Swiss Franc and Japanese Yen markets, many of the largest swaps markets in the world are now using new risk-free rates.

As we’ve said before, this is only the beginning of the end for LIBOR in U.S. dollar markets: the milestone dates so far only truly apply to the (albeit vast) dealer-to-dealer market, while the one-day, one-month, six-month and one-year USD LIBOR rates will finally cease publication in June 2023. But as we’ll detail below, the institutional market’s transition to SOFR – helped in no small part by the strenuous efforts of united regulators – is gaining momentum.

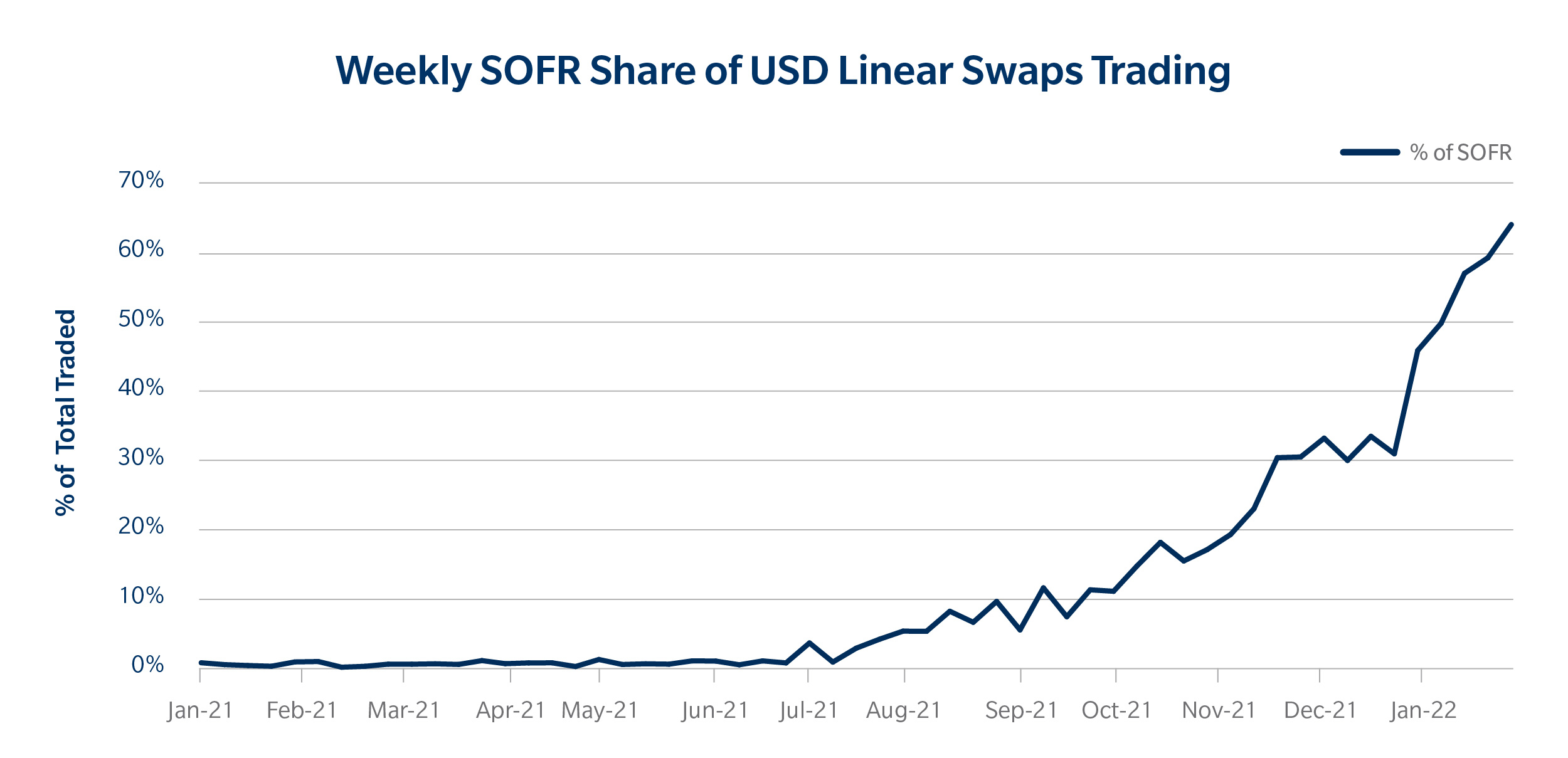

Source: TW SEF, % of Delta, excluding basis and inflation swaps

Essentially, client activity has inverted since December, when SOFR was between a quarter and a third of all new risk. Now SOFR has gained ascendancy: in January, SOFR trading on Tradeweb made up 72% of all new risk and across our business approximately 96% of our most active clients globally trading USD swaps are now using SOFR, and 89% of all clients have executed a SOFR-based trade.

Across our platforms, our functionality has been constructed to serve a SOFR market; since our first SOFR trade in April 2020, we have already executed more than $1.36tn of notional volume on our platform as our clients globally have transitioned away from LIBOR, with more than $668bn traded in SOFR in January alone.

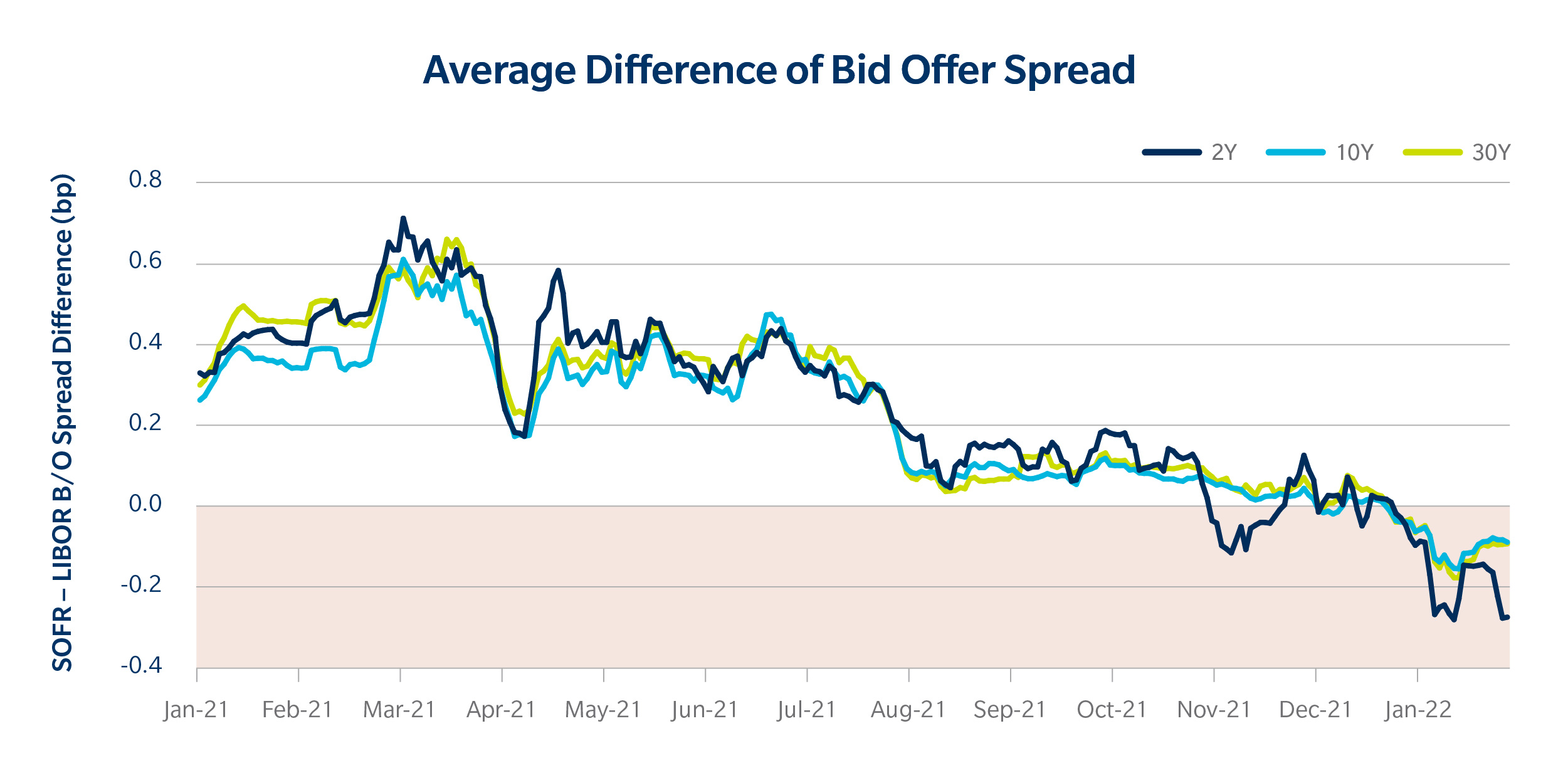

The change has been just as obvious in Bid Offer Spreads (BOS), which reflect the implied cost of liquidity for market participants. As Tradeweb’s Director of Research, Jonathan Rick, discussed in more detail here, we started to see SOFR median BOS improve compared to LIBOR spreads over the course of 2021, and particularly in response to SOFR First milestone demarcations. But the change since December 31, 2021 could not be clearer:

Yet another sign of the SOFR market’s maturation is burgeoning cross-currency swaps liquidity. In offering cross-currency swaps for the new RFRs across our platforms, our clients have the option of moving to the new floating rate options in this space.

Between the feedback we’re hearing from clients, and the very obvious inversion of liquidity and activity from LIBOR to SOFR, the dollar swaps market progression is moving forward in full force. We’ll be working with clients as fully as we can to keep up the pace.

More related content from Tradeweb:

RFR Resource Center

Making LIBOR Transition a Positive, Active Change

The Long Goodbye: Dollar Swaps Markets Bid Farewell to LIBOR

SOFR First Slowly, Then All at Once: Measuring the Market Transition from LIBOR

©Markets Media Europe 2025