The level of global debt is reaching crisis point, according to analysis from S&P Global Ratings, with debt issuance leading to lower levels of productivity and rising rates pinching fixed income as an asset class.

The level of global debt is reaching crisis point, according to analysis from S&P Global Ratings, with debt issuance leading to lower levels of productivity and rising rates pinching fixed income as an asset class.

A new paper written by Alexandra Dimitrijevic, global head of research & development, and Terry Chan, senior research fellow for credit research & insights at S&P Global Ratings has highlighted that there is no easy way to move from a position of record leverage and higher interest rates.

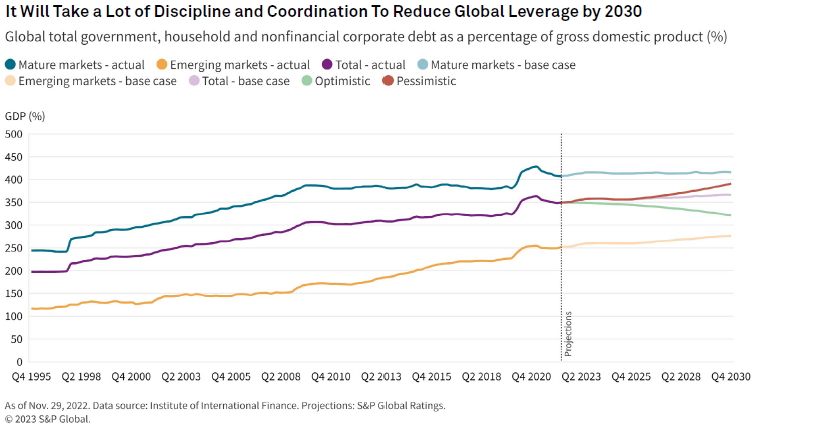

They note that global debt hit a record $300 trillion – 349% leverage on gross domestic product – which translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000.

Over the last fifteen years, government debt-to-GDP leverage grew by 76%, to a total of 102% from 2007 to 2022. Meanwhile Federal Reserve funds and European Central Bank rates were up an average of three percentage points in 2022.

“Assuming 35% of debt is floating rate, this means $3 trillion more in interest expenses, or US$380 per capita,” they noted.

The risk is a ‘Great Reset’.

“There is no easy way to keep global leverage down,” they write. “Trade-offs include more cautious lending, reduced overspending, restructuring low-performing enterprises and writing down less-productive debt. This will require a ‘Great Reset’ of policymaker mindset and community acceptance.”

©Markets Media Europe 2025