Tag: BlackRock

European bond trading impacted by 84% of flows to active open-ended funds

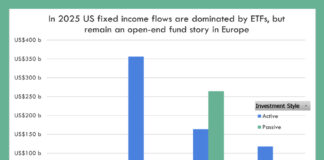

European fixed income fund flows remain structurally different from the US, materially affecting trading flows during the day. In 2025, 84% of Europe’s US$422.7bn net inflows went to active open-ended funds. US flows...

Kierton joins BlackRock

George Kierton has joined BlackRock as a vice president and emerging markets trader.

BlackRock holds a reported US$14 trillion in assets under management.

Earlier this week,...

Hsu jumps from BlackRock to Balyasny

Vicky Hsu has joined Balyasny Asset Management as head of counterparty credit, leaving BlackRock after more than 17 years.

Balyasny holds US$31 billion in assets...

Clifford drops Citi for BlackRock

Head of trading Paul Clifford has left Citi after more than a decade with the firm, joining BlackRock as a senior multi-asset trader.

He is...

MarketAxess launches FI opening and closing auctions

MarketAxess is launching opening and closing auctions for US credit “in the coming weeks”.

Opening and closing auctions have long been available in equity and...

The de-dollarisation debate

Investors see their short duration positions getting longer this year, with a shift to EM debt, and a multi-decade case for de-dollarisation, attendees at...

BlackRock and Standard Chartered make first India trade on MarketAxess

BlackRock and Standard Chartered have executed the first trade on MarketAxess’s Indian government bond (IGB) electronic trading solution.

MarketAxess became the first firm to offer...

Veiner switches to head of markets at BlackRock

Dan Veiner has been promoted to head of markets at BlackRock Global Markets and Index investments (BGM).

The business combines BlackRock’s market-facing functions with the...

Allianz, BlackRock, T&D Holdings invest in Viridium

Allianz, BlackRock and T&D Holdings have invested in German life insurance consolidation firm Viridium.

The three firms join Generali Financial Holdings and Hannover Re in...

BoE prepares for gilt shocks, opens CNRF applications

The Bank of England has opened applications for the Contingent Non-Bank Financial Institution Repo Facility (CNRF), preparing for further cases of gilt market dysfunction.

Details...