Tag: MarketAxess

Dan Burke joins MarketAxess

MarketAxess Holdings has appointed Dan Burke as global head of emerging markets. He reports to Raj Paranandi, chief operating officer for EMEA and APAC....

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...

Sunil Daswani rejoins MarketAxess

MarketAxess has confirmed the appointment of Sunil Daswani as senior sales relationship manager.

In the role, Daswani will lead business development efforts and deliver client...

MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key...

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

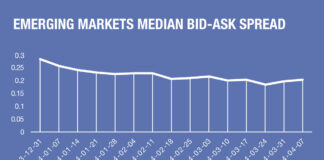

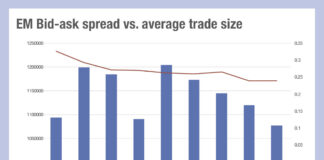

Volumes drop off as Q1 ends, but liquidity still cheap

A broad decline of trading volumes across European & US corporate bond and emerging market debt trading coincided with end of the first quarter...

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Subscriber

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

What is driving down EM trading costs?

Analysis of trade size and bid-ask spread data from MarketAxess’s CP+ pricing feed and Trax market data, which tracks activity across markets, indicates that...

MarketAxess re-launches Mid-X in Europe

MarketAxess has relaunched its matching session solution Mid-X in Europe, after simplifying the fee structure.

Mid-X offers daily, fully anonymous, matching sessions at the firm’s...