MARKET NEWS

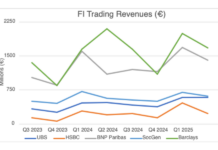

BNP Paribas sees yearly boost in FI trading revenues

BNP Paribas was the success story in Q2 2025 fixed income trading, reporting €1.4 billion in revenues. Despite reporting a 16% decline in revenues...

Spitz to lead Flow Traders

Flow Traders has named Thomas Spitz as CEO, effective 1 September, subject to shareholder approval.

He replaces Mike Kuehnel, who has been CEO for the...

StoneX becomes largest US FCM

StoneX has completed its acquisition of futures brokerage and clearing firm R J O’Brien, making it the latest non-bank futures commission merchant (FCM) in...

LoopFX goes live

FX liquidity network LoopFX has gone live after three years of development.

A total of 15 asset managers and banks have executed agreements with the...

JP Morgan taps Tradeweb for automated EGB basis trade

JP Morgan has selected Tradeweb for the execution of its first fully-automated European government bond (EGB) basis request-for-quote (RFQ) transaction.

Tradeweb’s platform allows for in-competition...

BlackRock and Standard Chartered make first India trade on MarketAxess

BlackRock and Standard Chartered have executed the first trade on MarketAxess’s Indian government bond (IGB) electronic trading solution.

MarketAxess became the first firm to offer...

FEATURES

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

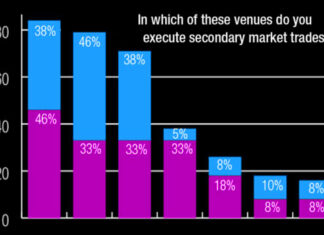

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

PROFILES

RESEARCH

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and...

Subscriber

Credit Spotlight

FROM THE ARCHIVES

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Agency Broker Hub: Business discontinuity

Business discontinuity: an ongoing threat for financial markets stability

By Lorenzo Bracchi and Monica Moschioni, Market Hub, IMI Corporate & Investment Banking, Intesa Sanpaolo

Financial markets have...

Deutsche Bank, Morgan Stanley, US Bancorp and Wells Fargo back Versana digital loan platform

Versana has announced the addition of four new banks – Deutsche Bank, Morgan Stanley, US Bancorp and Wells Fargo – as investors in its...

Asteria IM partners with Amundi for portfolio management system and dealing services

Asteria Investment Managers has adopted asset manager Amundi’s portfolio management system, the Amundi Leading Technologies & Operations (ALTO), for all of its assets under...

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Ancoa post-mortem: Spend was over four times greater than revenue

Ancoa, the troubled market surveillance firm that went into administration on 5 May 2017, had an average monthly spend of £450,000 in 2017, or...

YieldX launches new bond investment and portfolio management suite

YieldX, a new end-to-end platform for fixed income investing, has been launched to offer a new workflow for sourcing and trading fixed income assets.

Using...

Could ‘Fortnite’ guide market evolution

Online game ‘Fortnite’, Netflix and Spotify will drive technological advances in e-trading, Steve Toland, founder of TransFICC, told delegates at the Fixed Income Leaders...

Bloomberg launches benchmark bond indices to aid low-carbon transition

Bloomberg has launched the Bloomberg Government Climate Tilted Bond Indices, offering investors exposure to Bloomberg’s fixed income benchmarks with a specific focus on companies...

Insights & Analysis: UBS tracks rising quality in US high yield

In an analysis of US credit fundamentals for high yield (HY) debt, investment banking giant, UBS, via its HOLT valuation service acquired from Credit...

Under the hood of CBOE’s new US Treasury platform

Market and infrastructure operator, Cboe Global Markets, is planning to introduce a new dealer-to-dealer electronic trading platform for on-the-run US Treasuries called ‘Cboe Fixed...