Credit market liquidity has been positive in the first half of 2025, despite the high levels of volatility.

There are several dynamics which might be driving this. Firstly, although investment thesis have been impacted by dollar uncertainty and the subsequent reported rotation out of US assets into European, this has been gradual, avoiding a large directional move which is more challenging to trade through.

A recent Bank of America report identified that liquidity in credit default swap (CDS) indices, CDS index options and credit exchange traded funds (ETFs) was solid in the first quarter. However, more surprisingly, it found that cash bond liquidity metrics actually improved in parts, despite the sense of market fragility.

Barnaby Martin and Ioannis Angelakis, strategists in the credit team, wrote, “Portfolio trading (PT) has been a key tailwind for the physical market. We strongly believe credit investors should embrace the idea that a balanced investment thesis in a world of higher uncertainty needs a combination of physical and synthetic credit exposures, along with macro and micro trading approaches.”

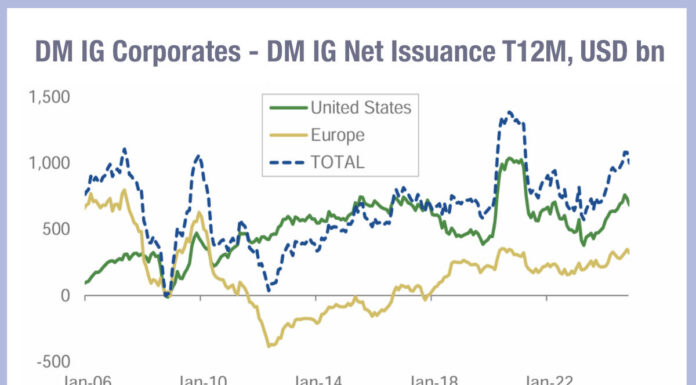

Increased market volatility typically increases pressure on corporate bond market liquidity. Portfolio trading (PTs) is perceived to be balancing out this pressure by ensuring that bonds are not only traded on the basis of immediately available liquidity.

“Over the past year or so, we have seen greater reliance on ‘macro’ vehicles to transfer physical bonds, which ‘mirror’ the benefits of ETF trading,” they write.

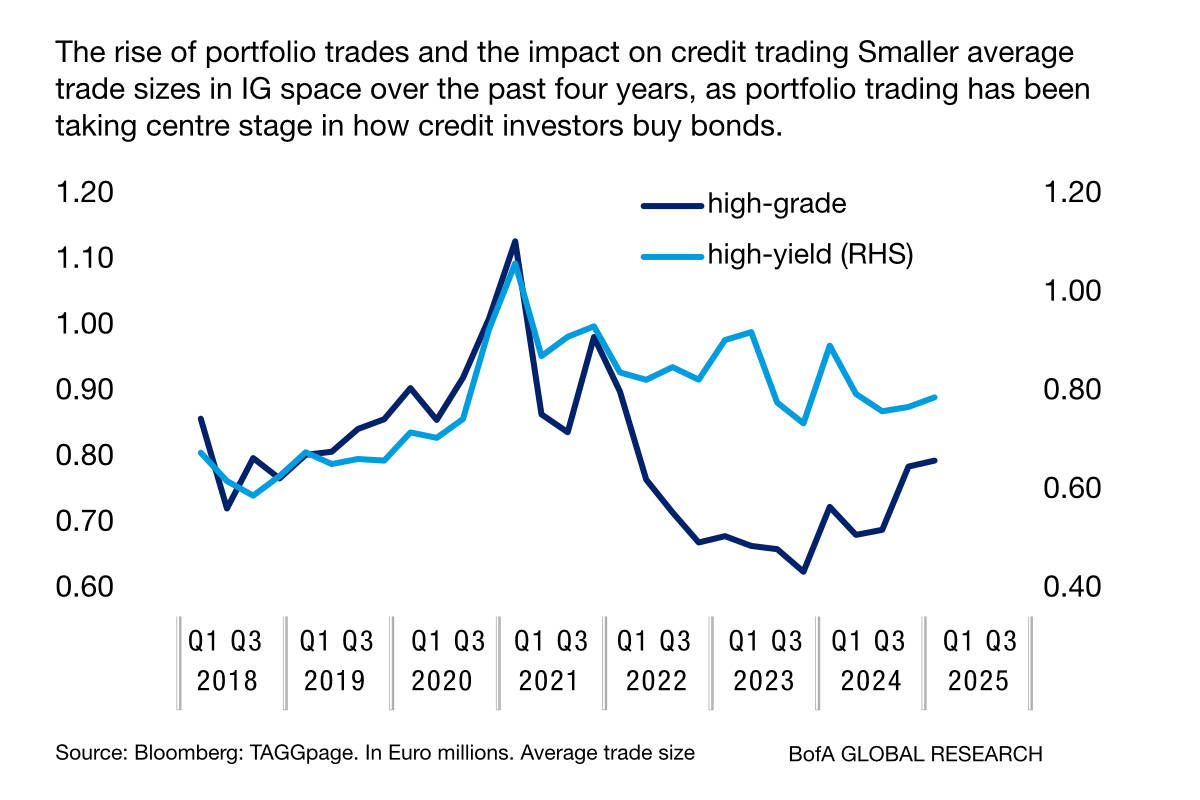

As portfolio trading has grown to hit somewhere north of 25% of market volume, it has also seen a greater amount of risk transfer and a higher number of trades coinciding with periods of higher market volatility. The effect is more pronounced in the investment grade market, improving transaction costs in bonds with a better credit rating.

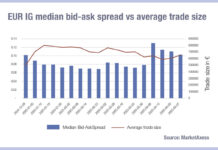

“We think that healthy market signs in the bonds space, especially the high-grade market, reflect lower ‘risk-free’ yields, and thus still-strong demand for credit, particularly short-duration paper.,” write Angelakis and Martin. “This has allowed market shocks to be absorbed and ultimately led to a “buy-the-dip” mentality. Traded volumes in euro-denominated credit markets increased, turnover metrics improved, and average trade sizes also headed higher YoY during the first quarter of 2025.”

©Markets Media Europe 2025