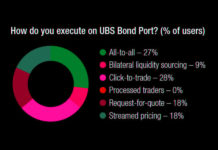

The DESK’s Trading Intentions Survey 2020 : UBS Bond Port

Adopting an agency approach has allowed UBS to deliver a service that has eluded many other banks via Bond Port.

As a result, the...

Subscriber

EMSs connect the dots in bond trading

Increased integration between venues and trading tools could herald far greater automation.

Moving a fixed income order from a portfolio manager to a counterparty is becoming...

CSDR mandatory buy-in delay welcomed

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI, Intesa Sanpaolo Group

Since the financial crisis waves of new regulation and the need...

Pre-trade data: The next generation

The first generation of pre-trade analytics are consolidating; the second generation of price and liquidity providers such as Bondcliq and Katana will need to...

An EMS built for bond trading

Trading protocols in fixed income are multiplying and becoming more dynamic, placing demands on trading desks that only an EMS can manage.

An execution management...

Tackling the cost challenge in fixed income trading

In today’s highly competitive and cost-conscious fixed income market, small and medium sized institutions can struggle without the efficiencies of scale which large institutions...

Europe’s liquidity rules are holding up… for now

New guidance on fund liquidity has followed redemption concerns in European equity and bond funds, writes Lynn Strongin-Dodds.

The risk that funds are unable to...

Repo market stress prompts calls for central bank support

Could central bank intervention bypass sell-side intermediaries, if they only act as agents not risk takers? David Wigan reports.

The stresses in the US repo...

Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...