The vicious circle of trust and liquidity

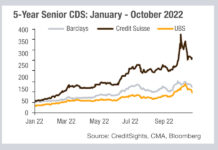

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

FILS 2021: Macros pressures not shaking bond investor confidence

Investors remain optimistic on debt markets despite the possibility of higher inflation, Fed tapering and disruption from structural changes in China according to discussions...

Alison Hollingshead joins Jupiter AM

Alison Hollingshead has joined Jupiter Asset Management as chief operating officer for investment management.

“I am delighted to be starting my new role as COO,...

Central clearing for bonds?

The lack of dealer liquidity provision during the March 2020 sell-off has triggered several proposals for market structure reform, not least in the US...

FILS 2021: Buy-side needs to make more noise for the right data

Data providers and regulators concur that the buy-side needs to communicate more clearly with politicians and suppliers if they are to get baseline bond...

AFM: No technical barriers for the implementation of a consolidated tape for fixed income

The Dutch Authority for the Financial Markets (AFM) sees no technical barriers for the implementation of a consolidated tape (CT) for fixed income. In...

Are issuers predicting a 6% Fed Funds rate?

Bond issuance has continued to beat expectations in February 2023. Last month saw 774 investment grade bonds issued globally, for a notional value of...

Europe will need to consider market liquidity to support issuance

NextGenerationEU is the EU's €800 billion temporary recovery instrument to support the economic recovery from the coronavirus pandemic and build “a greener, more digital...

Electronic credit platforms report fresh rises in trading volumes for March and Q1

Electronic bond market operators saw a new boost to volumes in March, and in the first quarter more broadly, as volatility in capital markets...

Dom Holland joins LedgerEdge

LedgerEdge, the distributed ledger ecosystem for corporate bond trading, has appointed senior fixed income specialist Dom Holland to the role of business development for...