Broadridge using OpenFin for PM and trader workspace

Broadridge Financial is to use OpenFin’s operating system for financial desktops for its new digital workspace solution. The tool is designed to support asset...

Low volatility hits Q2 MarketAxess earnings

Bond market operator, MarketAxess, reported revenues of US$176.3 million in the second quarter of 2021, down 4.6% against Q2 2020.

“Second quarter results were heavily...

Analyst firm Aité in merger to form Aite-Novarica Group

Analyst firms Aité Group and Novarica have merged to create the an advisory firm focused on helping executives from banks, payments providers, insurers, securities...

LedgerEdge appoints fixed income veteran Neal as CEO of US operations

LedgerEdge, the developer of an ecosystem for fixed income trading, has appointed industry veteran Michelle Neal as CEO of its US operations.

Her appointment will...

ICE sees $35 billion in AUM switched to its indices during H1 2021

Market and infrastructure operator Intercontinental Exchange has reported strong growth in its index business in the first half of 2021. This was driven by...

Tradeweb poaches Dan Cleaves to lead Dealerweb CLOB

Market operator Tradeweb has appointed Dan Cleaves, the former CEO of Brokertec Americas, as a managing director in its Dealerweb wholesale unit.

He said, “The...

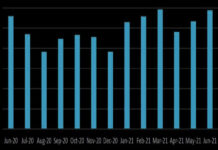

June sees European bond volume bounce back

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with...

Greco, founder of Direct Match, appointed MD at GTS… and he’s hiring

Jim Greco has been named managing director at market maker GTS, and has already launched a recruitment drive for coders to join his team.

Greco...

Mosaic Smart Data and Limeglass boost research analytics for banks

Analytics provider Mosaic Smart Data and Limeglass, the financial research specialist, have formed an alliance to help banks analyse research reports associated with client...

CME Group’s international rates ADV up 42% in Q2

Market operator and infrastructure provider CME Group has reported its international average daily volume (ADV) reached 5.1 million contracts in Q2 2021, up 6%...