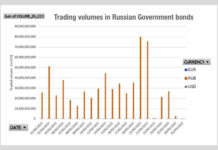

A very clear contrast in trading volumes as sanctions bite

The second chart this week shows trading in Russian government bonds which fell off a cliff at the start of March, triggered by an...

Liquidnet adds trading in the South African bond market

Block and agency trading specialist Liquidnet, a TP ICAP company, is partnering with TP ICAP South Africa to support bond trading.

The firm reports...

CME Group launches price comparison tool for cash US Treasuries and futures

Derivatives market operator, CME Group, has launched UST Market Profile, a tool to bring together listed Treasury futures and BrokerTec cash treasuries in one...

Billy Hult to become new Tradeweb CEO

Tradeweb, the rates, credit, equities and money market operator, has announced a number of changes to the board of directors and succession plans for...

Charles River and LedgerEdge collaborate on DLT-enabled credit liquidity and trading services

Charles River Development, a State Street Company, is collaborating with distributed ledger bond market specialist LedgerEdge, to provide investment firms with access to corporate...

Tradeweb sees strong January; adds Jump Trading to European rates market

Tradeweb Markets has added Jump Trading to its European government bond marketplace to provide bank participants with streaming liquidity via the new Tradeweb EUGV...

Nash Panchal named new CIO at MarketAxess

Bond market operator, MarketAxess, has named Nash Panchal to succeed Nick Themelis as MarketAxess’ chief information officer (CIO). MarketAxess previously announced Themelis’ retirement from...

Liquidnet’s direct link from O/EMS to syndicate banks deployed by Charles River

Block trading specialist and agency broker, Liquidnet, has unveiled a new feature in its new issuance platform for corporate bonds, intended to enable investors...

MarketAxess reports record revenue in 2021

Bond market operator MarketAxess saw total revenues for 2021 increase 1.4% to a record US$699 million, compared to US$689.1 million for 2020. Operating income...

Société Générale, HSBC and MUFG join DirectBooks; US$1.6 trillion processed in 2021

Société Générale, HSBC, and Mitsubishi UFJ Financial Group (MUFG), have joined the DirectBooks platform bringing the total to 19 global underwriters live on DirectBooks.

In...