Viewpoint: Technology and the evolution of fixed income trading

Steve Toland, co-founder TransFICC

The fixed income and derivatives market is evolving, rapidly migrating away from the phone onto electronic venues. Electronic trading satisfies the...

Neptune 2.0 – How the new platform will deliver better investment and trading

Axe distribution service, Neptune, is evolving through a transformation of underlying technology, elevating its services to a new level.

Neptune’s CEO, John ‘Coach’ Robinson, and...

Industry viewpoint: Forging fixed income’s future

How technology is enabling data-driven execution and analytics.

In recent years, the electronification of fixed income (FI) markets has been followed by the development of...

Industry viewpoint: How electronic RFQ has unlocked institutional ETF adoption

Adam Gould, Head of Equities, Tradeweb.

Institutional investors continue to embrace ETFs as a low cost, highly liquid, flexible answer to a wide range of...

The Agency Broker Hub | An open gateway into financial markets

By Gherardo Lenti Capoduri, Head of Market Hub, and Barbara Valbuzzi, CFA, Head of Market Strategy, IMI CIB Division, Intesa Sanpaolo.

In recent years the sellside...

Industry viewpoint: How to build a better picture of the global fixed income markets

Guido Galassi, Head of Data & Cash Product, MTS

In volatile market conditions, more accessible and meaningful data has become critical to navigating the path...

Market volatility and automated trading decision-making

Gain greater confidence in your automated trading decisions during market volatility

By Charlie Campbell-Johnston, Managing Director, AiEX & Workflow Solutions at Tradeweb.

In times of volatility, traders...

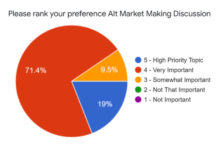

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Euronext’s vision for European fixed income

An interview with Fabrizio Testa, Head of Fixed Income Trading at Euronext.

What are the components of Euronext’s fixed income offering today?

Following the acquisition of...

The positive impact of desktop interoperability on trade execution – David Rickard

Traders can add more value in analysis and decision-making than they can as connections between systems.

Removing operational bottlenecks allows buy-side traders to provide better...