A new model for predicting fixed income trading costs

BestX, the execution quality analysis provider, has launched a new tool for fixed income traders to support their pre-trade capabilities.

The ‘Expected Cost’ model is...

Bloomberg introduces new fixed income pre-trade TCA model

Bloomberg has launched a new pre-trade transaction cost analysis (TCA) model that helps market participants to assess trade cost, daily executable volume, and probability...

PBI integrates 7 Chord’s BondDroid fixed income pricing

PBI has integrated 7 Chord’s near real-time, delayed, and end-of-day bond prices for corporate, sovereign and government bonds within its investment management systems, which...

Positive reception of FCA consolidated tape plans keeping pace with Europe

A consultation on plans for a consolidated tape of fixed income prices, announced by the UK’s Financial Conduct Authority (FCA), has drawn support from...

Treasuries HFT hack test results released

The impact of a simulated cyberattack on a high-frequency trading (HFT) firm in the US Treasury (UST) market has been released by the Treasury...

S3 helps buy side analyse counterparty performance

By Flora McFarlane.

S3 has added contra reporting functionality to its Fixed Income Execution Quality Suite in order to provide greater insight for clients into...

thinkFolio integrates Investor Access to support primary market workflow

IHS Markit's thinkFolio investment management platform has integrated with the firm's Investor Access primary market workflow tool, to provide fixed income issuance support within...

SOLVE’s Ticker boosts muni market price transparency

SOLVE, provider of pre-trade quotes data across fixed income markets, has rolled out ‘Ticker’, its municipal market data offering as part of the SOLVE...

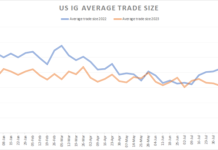

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

UK proposes streamlined listing regime, confirms consolidated tape for bonds

UK market regulator, the Financial Conduct Authority (FCA), has set out proposals aimed at making the UK’s listing regime more “accessible, effective, and competitive.”

In...