The war in Ukraine outside of Europe is, from a capital markets perspective, driving a ‘risk-off’ attitude across issuers, buy-side and sell-side firms. As previously noted, the effect is visible in bond markets but to very different degrees, depending upon the class and location of the debt.

“[The Russian invasion of Ukraine] has made a bad situation even worse” the CreditSights team noted of Asia Pacific markets, as it led to a general sell off in names across Asia regardless of any direct link with Russia/Ukraine war.

Recent analysis published by CreditSights has found that in China, a market which already had issues in several sectors most notably property, the effect of the Ukraine war is being felt more than anywhere else in the region. Likewise, the Institute of International Finance has published a report on 24 March which observed sizable fund flows out of China, second only to the COVID 19 outbreak in 2020 over the past decade.

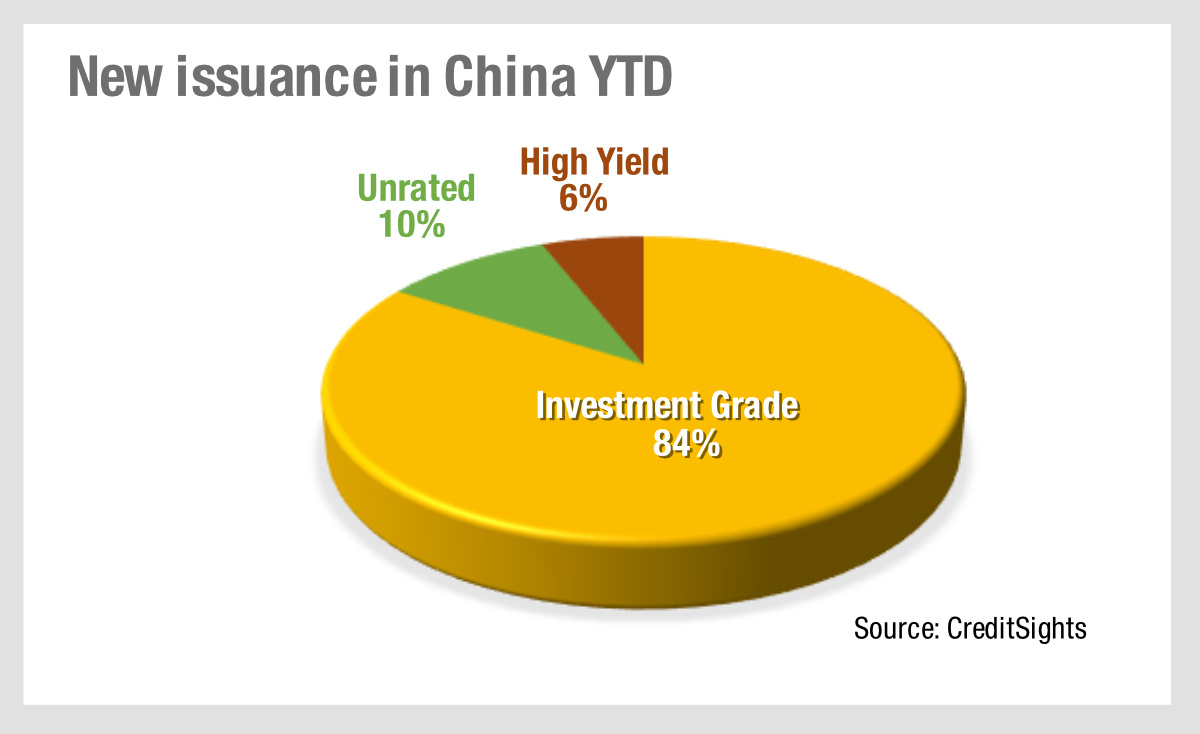

So, while the unpredictability of war is driving broader market volatility, more specific risks, including the spill-over of sanctions into countries that use Russian resources, is considerable. As 15% of China’s crude imports come from Russia as does much of its natural gas there is a potentially a direct link. However, as confidence exists in the ability of the government to prevent widespread defaults, it is worth understanding the nuanced risk picture. For example, the CreditSights analysts report that the backing of the Chinese government is reflected in the primary market where investment grade borrowing has dominated, with 84% of new issues, while only 6% of borrowing has been via high yield Chinese debt.

In these circumstances, the devil is in the detail. CreditSights has warned that in the universe of Asian credit it has only changed one recommendation on the back of the Ukraine crisis.

Market sentiment may not reflect fundamentals in a risk off scenario, as investors vote with their hearts over their spreadsheets. Given that, and the considerable sell-off in Asian credit that appears to be a response to the war, the adage that ‘Markets can stay irrational longer than you can stay liquid’ seems to be a clear concern at this point. Risk by association, rather than correlation, is not easily predicted.

Consequently, getting the data to build an accurate picture of the detail around broader market activity as well as fundamentals will be key to making effective investment and trading decisions going forward.

©Markets Media Europe 2025