Vicky Chan returns to HKEX

Hong Kong Exchange & Clearing Limited (HKEX) has appointed Vicky Chan as managing director and head of post trade, effective 5th August. She replaces...

BondWave reports volume/liquidity paradox

Trading efficiency has driven down the costs of trading, and supported the ability to find liquidity, despite falling volumes, says BondWave’s Paul Daley, MD...

US inflation hits its highest level in three decades

Jonathan Baltora, head of sovereign, inflation and FX at AXA Investment Managers says, “US inflation rising by 0.9% in just one month brings it...

JP Morgan takes stake in Mosaic Smart Data

UPDATE:

Further to our post of 23rd October, 2017, Mosaic Smart Data announced today that JP Morgan has added Mosaic Smart Data to its strategic investments...

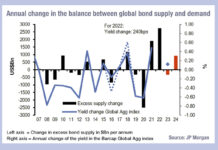

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

Chatham Asset Management fined for improper bond trading

The Securities and Exchange Commission (SEC) has charged New Jersey-based Chatham Asset Management and its founder, Anthony Melchiorre, in connection with improper trading of...

First U.S. corporate bond index futures

Cboe, IHS Markit and BlackRock Join Forces to Launch First U.S. Corporate Bond Index Futures

Source: Cboe Global Markets, Inc. May 16, 2018, 08:30 ET

CHICAGO, May 16, 2018...

FILS USA: The roadblocks to electronic fixed income trading

Fixed income markets moving toward electronic trading has been a recurring theme in the industry for a number of year, but there are roadblocks...

Diligent and S&P Global Market Intelligence launch insights reporting service

Governance, risk and compliance software firm Diligent has partnered with S&P Global Market Intelligence to launch Diligent Market Insights Reporting.

The service provides reports on...

SEC signs off US Treasury clearing for cash and repo

The US Securities and Exchange Commission (SEC) has adopted a rule designed to reduce risk in the US Treasury market by ensuring that more...

Schleifer: “Explosive growth” for desktop interoperability as Finsemble goes solo

Cosaic is spinning off its desktop interoperability platform, Finsemble, following the sale of its Chart IQ to S&P Global, as a new company. The...

Bloomberg unveils fully automated basis trade and reporting workflow

Bloomberg has rolled out a fully automated electronic workflow for the trading and reporting of EUR interest rate swap (IRS) v bond future contracts...