Tradeweb and FTSE Russell launch closing prices for Euro govies

Multi-asset market operator, Tradeweb Markets, has collaborated with FTSE Russell to launch benchmark closing prices for European government bonds.

Calculated in accordance with the...

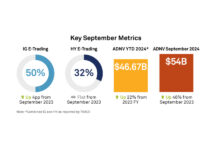

September: US corporate bond ADNV hits $54bn, up 46% YoY

The average daily notional volume (ADNV) for US corporate bonds hit a new high of US$54 billion in September 2024, a 46% increase compared...

Buy-side firms may dominate front office tech

Buy-side firms need to make secular decisions about whether to buy or sell technology to other asset managers. Dan Barnes reports.

In April, CEO of...

TransFICC secures US$25 million Series B led by Citadel Securities

TransFICC, a provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has secured US$25 million in a Series B fundinground...

7 Chord’s EM sovereign and corporate bond feed prices on Nasdaq’s Quandl

Predictive bond prices and analytics provider, 7 Chord, has expanded its data offering on Nasdaq's Quandl. Bond investors and dealers can now leverage Python,...

CFTC proposes changes to swaps reporting

The Commodity Futures Trading Commission (CFTC) has put forward two proposals, the first to amend certain rules regarding the reporting and information regulations applicable...

Buy side reports price movement risk in Treasury trading

Automated trading and derivatives are changing the way US Treasuries are traded, exposing the buy side to high-frequency trading strategies. Chris Hall reports.

If big...

Refinitiv report on fixed income trading finds strong appetite for automation

Refinitiv, part of the London Stock Exchange Group, and analyst firm Coalition Greenwich, have released a report on the evolution of trading in fixed...

TP ICAP completes Liquidnet acquisition

TP ICAP has finalised the acquisition of Liquidnet, which will enable the interdealer broker to tap into significant growth in dealer-to-client rates and credit...

Central clearing for bonds?

The lack of dealer liquidity provision during the March 2020 sell-off has triggered several proposals for market structure reform, not least in the US...

TABB Group shuts down

Larry Tabb, the eponymous founder of market anayst firm TABB Group, has announced the firm will close. Making the announcement via Twitter, he wrote:...

Voya announces leadership-succession plan for Voya Investment Management

Voya Investment Management CEO Christine Hurtsellers is to retire later this year, becoming a strategic advisor to the company until her retirement.

Hurtsellers said, “The...