S&P and CME offload OSTTRA to KKR

S&P Global and CME Group have agreed to sell their post-trade solutions business OSTTRA to global investment firm KKR.

The US$3.1 billion enterprise value deal...

SEC – controversially – moves to standardise best execution rules for broker-dealers

The Securities and Exchange Commission (SEC) is proposing new rules under the Securities Exchange Act of 1934 relating to a broker-dealer’s duty of best...

Me the Money Show – Episode One

In this pilot episode, Markets Media Group editors Dan Barnes and Terry Flanagan discuss current conditions in institutional capital markets. Topics covered include how...

MarketAxess re-launches Mid-X in Europe

MarketAxess has relaunched its matching session solution Mid-X in Europe, after simplifying the fee structure.

Mid-X offers daily, fully anonymous, matching sessions at the firm’s...

Banks see strong Q3 across credit, rates following heightened activity earlier in the year

A new report by analyst firm Crisil Coalition has found that the unprecedented levels of volatility and trading activity seen in the first half...

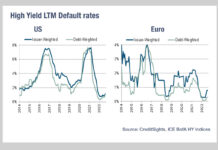

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

Exclusive: Kirstie MacGillivray named UK CEO of Aegon AM

Kirstie MacGillivray has become the UK CEO of Aegon Asset Management, a buy-side firm with €315 billion assets under management. MacGillivray has been the...

Liquidnet’s direct link from O/EMS to syndicate banks deployed by Charles River

Block trading specialist and agency broker, Liquidnet, has unveiled a new feature in its new issuance platform for corporate bonds, intended to enable investors...

Substantive Research reports market data pricing inconsistencies

Substantive Research, the data discovery and analytics provider for buy side firms, has published analysis of market data pricing, with a focus on opaque...

Financial Conduct Authority approves Trax and Tradeweb for MiFID II Reporting

By Flora McFarlane.

The Financial Conduct Authority (FCA) has granted approval to Trax and Tradeweb as Approved Publication Arrangement (APA) for transparency and reporting under...

Chinese govies step closer to collateral acceptability

Acceptance of Chinese government bonds as collateral will hinge upon rule changes around defaults. Lynn Strongin Dodds reports.

The use of Chinese government bonds as...

MeTheMoneyShow : Brexit Schmexit and a passing of the old guard

In this podcast Dan Barnes speaks with Lynn Strongin Dodds on how the USA is winning derivatives business from the UK - to the...