Lifetime Achievement Winner: Pimco’s Geraldine Sundstrom

The importance of agility in a changing world.

Geraldine Sundstrom is a managing director and portfolio manager at PIMCO and in 2022 won the Lifetime Achievement Award at...

First U.S. corporate bond index futures

Cboe, IHS Markit and BlackRock Join Forces to Launch First U.S. Corporate Bond Index Futures

Source: Cboe Global Markets, Inc. May 16, 2018, 08:30 ET

CHICAGO, May 16, 2018...

Making prices more easily

If dealers cannot make prices investors will have to, and many firms are stepping up to offer greater access to pricing and liquidity data....

Amber Wright picks up EMEA sales role at RJ O’Brien

Futures brokerage and clearing firm RJ O’Brien has appointed Amber Wright as head of EMEA sales. She takes on the role in addition to...

TMPG: US Treasuries supply may strain market makers; Fed guidance a concern

Newly released minutes from the Federal Reserve’s Treasury Market Practices Group, an industry-led advisory body on market structure and trading, has indicated concern about...

On The DESK : Stuart Campbell : BlueBay Asset Management

STUART CAMPBELL: OUTPERFORMANCE AND AUTO-EXECUTION.

Leading the charge into electronic trading, Stuart Campbell tells The DESK how he has set up his team to prevail.

Which characteristics...

Origination: Government bond supply next week

Nominal supply of bonds scheduled in the Euro area next week is expected to level at €17.8 billion of European government bonds (EGBs), according...

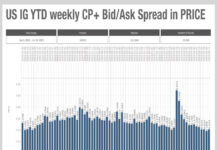

Liquidity costs ticking up as the heat rises

Summer is seeing the cost of trading in fixed income markets begin to tick up again, as bid ask spreads begin to widen, according...

Europe’s government bond market hits electronic ceiling

Electronification of rates in Europe could significantly enhance liquidity and boost trading. David Wigan investigates.

Electronic trading of European government bonds may face a natural...

FILS USA: How can high yield be traded efficiently in a risk off environment?

Banks are stepping back from taking risk in high yield trading. Trading in a risk-off environment in normal circumstances can be challenging as spreads...

Utility mooted to reduce data onboarding friction

While data has become more abundant across the fixed income ecosystem, making it useful remains a major challenge.

“Some of our desks manage hundreds of...

Repo ripe for evolution

The broken mechanics of the repo market have been exposed creating demand for change says Roberto Verrillo, Head of Strategy and Markets at Elixium.

“Those...