IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

In uncertain times, corporate bond traders seek certainty of execution

Portfolio trading has emerged as a go-to mechanism to buy or sell many bonds at once.

Traders want the best price - but they also...

European Women in Finance : Else Braathen : A call to action

Else Braathen, risk domain manager at SimCorp talks to Lynn Strongin Dodds about risk management, stress testing and staying calm.

Although Covid-19 has shaken the...

Fixed income leads the way for revenue growth at Euronext

Euronext saw record income and revenue in Q1 2024, up 8% YoY to €401.9 million.

In the exchange’s results call, CEO and managing board chairman...

Man Group names Sam Ratcliff head of order management and analytics

Man Group’s Sam Ratcliff has been named head of order management and analytics – markets platform technology.

Formerly heading up the firm’s execution technology division,...

Substantive Research reports market data pricing inconsistencies

Substantive Research, the data discovery and analytics provider for buy side firms, has published analysis of market data pricing, with a focus on opaque...

BNP Paribas Asset Management names new head of global trading

BNP Paribas Asset Management has appointed Sophie Lugiez as head of the Global Trading Function (GTF). Based in Paris, Lugiez reports to Rob Gambi,...

HSBC splits

An organisational switch-up at HSBC, effective 2025, sees the bank prioritise its Hong Kong and UK operations with dedicated business lines.

HSBC Holdings will operate...

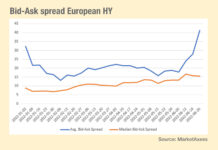

Bid-ask spread betting in credit

Betting how bid-ask spreads will move this year has been made more challenging by a dislocation between the mean average and the median bid-ask...

Propellant adds TRACE data to global FI data platform

Propellant Digital is adding TRACE data to its global fixed income data platform, increasing its coverage of US and European bond and derivative data.

Vincent...

Raiffeisen Bank rolls out Chronicle FIX for global ETD business

Chronicle Software, a specialist provider of low-latency microservices and technology for financial services, has expanded its footprint in Raiffeisen Bank International.

The bank has rolled...

Wellington: Internal crossing could have saved US$10-15 million

The Securities and Exchange Commission (SEC) sub-committee the Fixed Income Market Structure Advisory Committee (FIMSAC), has unanimously passed a proposal to support internal crossing...