CME Europe and CME Clearing Europe to close by year end

CME Group is to close its London-based derivatives exchange and clearing house, CME Europe and CME Clearing Europe, by year-end 2017. The announcement follows Nasdaq...

MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key...

Chatham Asset Management fined for improper bond trading

The Securities and Exchange Commission (SEC) has charged New Jersey-based Chatham Asset Management and its founder, Anthony Melchiorre, in connection with improper trading of...

FILS USA 2022: Will Europe become more transparent than the US?

European including of government bonds within its consolidated tape, and a new joint venture amongst platform giants Bloomberg, MarketAxess and Tradeweb, could allow Europe...

The Agency Broker Hub: The fixed income ETD market – what are 2022’s main...

By Carmine Calamello, Head of Brokerage & Execution, Market Hub, Intesa Sanpaolo, IMI CIB Division.

After a decade of expansionary monetary policy and interest rates close...

Portfolio trading proves transformational, but controversial

The US market has been transformed by portfolio trading (PT) this year, with estimates that PT makes up somewhere between 25-40% of dealer-to-client (D2C)...

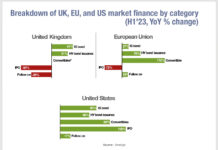

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

Reducing trading costs under the UMR microscope

Asset managers able to assess their exposure to uncleared margin rules can significantly reduce their administrative and trading costs.

In July 2019, the Basel Committee...

Research profile: DirectBooks’ magic sauce

The DESK spoke with Rich Kerschner, CEO of DirectBooks, to understand what the magic ingredient is behind their success.

What has given DirectBooks the lead...

Subscriber

The liquidity bears’ picnic

If you are on the desk, there is often an inverse relationship between the tension you experience and the volume of people relaxing on...

European Commission pushes consolidated tape for primary and secondary bond market

The European Commission (EC) has set out a wide ranging process to “stimulate the openness, strength and resilience of the EU's economic and financial...

FCA says HFT firms exacerbate and profit from flash crashes

A paper published by the UK’s Financial Conduct Authority has said that high-frequency trading (HFT) firms and agency traders exacerbate flash crashes in the...