New Aité report provides detailed analysis of fixed income EMS capabilities

A new report from the Aité Group, penned by Audrey Blater and Matt Simon, has provided an in-depth look at the execution management system...

BlackRock CEO backs blended active/passive bond portfolios

Larry Fink, chairman and CEO of investment giant BlackRock, has advocated the use of blended active and passive portfolios to optimise fixed income investments.

In...

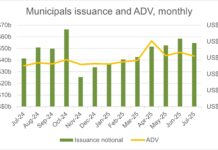

Insight & Analysis: Municipals’ primary and secondary markets hit records

According to Sifma data, municipals’ primary markets issued a record US$162.8 billion of new debt in the second quarter of 2025, eclipsing the previous...

AxeTrading and Mosaic Smart Data collaborate on bond market analytics

AxeTrading, the fixed income trading software provider, and Mosaic Smart Data, the real-time capital markets data analytics company, are integrating the AxeTrader execution management...

JP Morgan veteran poached by Old Orchard Capital Management

Jared Fand has joined New York-based investment management firm Old Orchard Capital Management as a trader, leaving JP Morgan after more than a decade...

US unbundling does not impose fiduciary execution rules on dealers

By Flora McFarlane.

US banks are able to unbundle trade execution and research payments without incurring fiduciary responsibility for trade execution. Following a lengthy process...

Subscriber

On The DESK: Kirstie MacGillivray, CEO and head of investment dealing, Aegon AM UK

As CEO of Aegon UK and its head of investment dealing, Kirstie MacGillivray has a unique perspective across the front office and the board room...

CFTC commissioner voices cost concerns around proposed technical data reporting standards

Along with a number of financial regulatory agencies, the Commodity Futures Trading Commission (CFTC) has approved a rule proposal to establish technical data reporting...

PGIM: Research indicates liquidity event is tail risk with greatest impact

In a survey of 400 senior investment decision-makers at institutional investors in Australia, China, Germany, Japan, the UK and the US with a combined...

Bond platforms report record trading volumes for March

The March 2020 numbers are in for bond trading platforms MarketAxess and Tradeweb and both have seen record results, in a period that has...

Daniel Mayston leaves BlackRock

Daniel Mayston has resigned from BlackRock after nearly 20 years at the world’s largest asset manager, according to sources close to the company.

Mayston was...

LSEG: The outlook for muni bonds (video)

Global Trading editor Laurie McAughtry (on behalf of The Desk) was delighted to sit down with Domenic Vonella, director of US municipal bonds at...