S&P Global completes sale of Fincentric

S&P Global has completed the sale of its Fincentric business to Stellex Capital Management, a global private equity firm. The transaction does not have...

Head of FI trading Harrington departs BMO Global Asset Management

BMO Global Asset Management has confirmed that Marc Harrington has left the firm as head of fixed income dealing. Harrington is a highly experienced...

Bloomberg rival Money.Net partners OpenFin to scale up

By Shobha Prabhu-Naik.

Money.Net, a provider of live streaming financial market data, has selected desktop operating system OpenFin to deploy and deliver its software at...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

This Week: James Athey, Marlborough

Marlborough: Bond markets zero in on Fed signals and tariff risks.

Bond markets will be closely watching employment data this week says James Athey, senior...

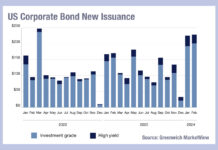

Issuing at the top of the market

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high...

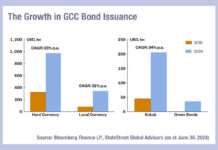

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

The new normal: Top 2024 market structure trends

A new report from Coalition Greenwich outlines the trends set to define markets in 2024, with insights gleaned from clients and ongoing research.

Dan Connell,...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

Under the skin of new US crossing rules

Crossing trades internally would have saved US investors many millions in March. Dan Barnes reports.

US market regulator the Securities and Exchange Commission (SEC) is...

Jude Driscoll named MetLife Investment Management president

MetLife Investment Management (MIM) has appointed Jude Driscoll as president, effective 1 September.

In the Philadelphia-based role, Driscoll is responsible for MIM’ strategy and business...

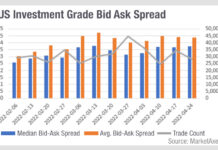

Is US investment grade market-making starting to fray?

In US credit, mean bid/ask spreads are skewing upwards from the median, indicating that a greater proportion of larger spreads are in some cases...