China Focus: The secondary effect of defaults

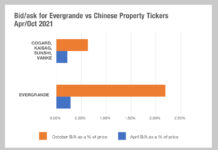

The bid-ask spread for bonds in China’ property market has expanded by 300% this year, although even more so for Evergrande which increased by...

ICE acquires American Financial Exchange

Intercontinental Exchange (ICE) has acquired the American Financial Exchange (AFX) in its entirety.

The electronic exchange, which facilitated direct lending and borrowing for American banks...

Bhuchar replaces Cox as head of FI trading at JPM AM

Nick Cox left his position at JP Morgan Asset Management as global head of fixed income trading at the end of 2017, a spokesperson...

JP Morgan sees 20% YoY drop in Q3 fixed income revenue

JP Morgan has seen a significant drop in Q3 trading revenues, with fixed income falling to US$3.67 billion, a drop of 10% against the...

TradFi meets DeFi: Integrating FIX and distributed ledgers

Led by global co-chair Digital Assets & Technology Committee, Vince Turcotte, 35 participants from the APAC digital assets ecosystem gathered at the 23rd Asia...

Jenny Bloomfield swaps Schroders for Kuwait Investment Office

Kuwait Investment Office has appointed Jenny Bloomfield as a senior Treasury dealer. She is based in London.

Bloomfield has 20 years of industry experience and...

Glue42 aims to boost buy and sell-side internal collaboration

Glue42, the desktop tools integration specialist, has released a new version of its open-source platform, Glue42 Core. The new release, version 2.0, is designed...

Technology : How smart is dealer AI? : Dan Barnes

Can artificial intelligence boost broker-dealers’ client coverage?

Simple automation will not work for complex bond markets; tools that learn to find patterns are needed...

CIOs assess stormy markets ahead

Managers can expect an even worse start to 2020 than they endured in 2019, unless credit markets see an adjustment, according to Chris Iggo,...

Viewpoint: What an institutional trader needs to know about FI ETFs and futures

Where instrument selection can be key, understanding cash and derivatives instruments and the interplay between them is invaluable.

The DESK spoke with Joyce Choi, director...

Understanding Portfolio Trading

Li Renn Tsai, Head of Products and Sales, Asia, at Tradeweb explains how Portfolio Trading can improve bulk trades of bonds by creating cost savings,...

Houlihan Lokey adds to capital markets team with veteran hire Michael Hommeyer

Global investment bank Houlihan Lokey has appointed Michael Hommeyer as managing director in its capital markets group.

Based in New York, Hommeyer will lead a...