BNP Paribas issues first Eurozone sovereign digital bond

BNP Paribas has arranged and placed the first sovereign digital bond issuance for Eurozone and EMEA in the Republic of Slovenia.

The digital securities coupon...

Private markets data deal reflects steady march to mainstream

UBS:

CIO Daily – Private markets data deal reflects steady march to mainstream

Europe’s pension fund managers face rising margin costs as EU clearing exemption deadline looms

European pension fund managers are facing rising margin costs thanks to the increased cost of financing additional collateral payments just as the EU’s clearing...

The Agency Broker Hub: The fixed income ETD market – what are 2022’s main...

By Carmine Calamello, Head of Brokerage & Execution, Market Hub, Intesa Sanpaolo, IMI CIB Division.

After a decade of expansionary monetary policy and interest rates close...

The case for deferring reports of larger trades

The Association for Financial Markets in Europe (AFME) has published study consolidating fixed income trading data from numerous sources for the period of March...

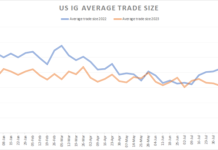

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

FILS USA 2022: News you may have missed this week

Treasury launches new effort to improve resilience of its market

The US Department of the Treasury, in consultation with the Inter-Agency Working Group on Treasury...

Buy side issues framework to standardise bond issuance

The Credit Roundtable, a buy-side lobby group for bondholder protection has issued an ‘Investment Grade Primary Best Practices Framework’ designed to improve bond issuance.

The...

DTCC affirmation rates up for April – but investment managers lag

DTCC affirmed 83.5% of transactions by the DTC cutoff time – 9:00 PM ET on trade date – in April 2024, it has reported.

This...

Is portability via indirect clearing under threat?

As sell-side relationships are harder to come by, indirect clearing offers hope for smaller buy-side firms, but without mandated asset segregation many may find...

SSGA launches new bond ETF on Barclays Global Aggregate index

State Street Global Advisors (SSGA) has launched the SPDR Barclays Global Aggregate UCITS exchange traded fund (ETF). The fund is available unhedged on the...

Ending technology asymmetry in primary markets for bonds

By Rahul Kambli, Senior Product Owner, Genesis Global.

Accessing the primary market for corporate bonds can be lucrative for asset managers astute about pricing and...