Tradeweb’s annual client letter – in full

The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough...

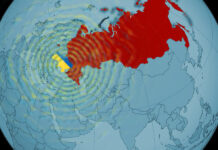

How e-trading connectivity has been fragmented by sanctions

Sanctions on the Russian regime, on associated firms and on individuals have restricted legal access to some instruments and counterparties, yet portfolio managers may...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

Trumid zeroes in on data automation, appoints Ryan Gwin

Trumid has expanded its data and intelligence and automation divisions, appointing Ryan Gwin as head of data solutions. The divisions were established four years...

Raiffeisen Bank International executes first non-standard interest rate swaps

AxeTrading has extended its fixed income products’ offering to support non-standard interest rate swaps which is being used by its client, Raiffeisen Bank International...

ICE Bonds builds on corporate bond volume records

ICE Bonds has introduced price improvement volume clearing (PIVC) to its risk matching auction (RMA) corporate bonds protocol.

RMA executes dealer-to-dealer sweep auctions, matching buyers...

US primary dealer bond trading hits record low

US Treasury market volatility saw a decline in March, according to Coalition Greenwich’s April Data Spotlight on US rates trading. The MOVE Index monthly...

Tangible returns from bond trade automation

Adoption of automated trading continues apace across several bond markets and within different grades of instrument. Gareth Coltman, global head of automation at MarketAxess,...

Connectivity vs relationship control is on the agenda at FILS

Support for streaming firm prices is contingent on connectivity between price-makers and price-takers; a big question which will play out over this year’s Fixed...

Trivedi joins Nuveen Credit Strategies Income Fund, expanding asset allocation

Nuveen Credit Strategies Income Fund has seen the firm’s head of structured credit, Himani Trivedi, appointed to the firm’s portfolio management team.

Trivedi is...

Wave Labs launches Systematic Investment Application for building systematic credit strategies

Execution management system (EMS) provider, Wave Labs, is launching its Systematic Investment Application (SIA), a new modular system for developing systematic strategies in the...

Mike Rosborough, CalPERS: On truth and transparency

Dating back to the 1930s, the California Public Employees Retirement System (CalPERS) is the largest pension fund in the United States. Mike Rosborough, senior portfolio...