RBC joins ICE Clear Credit

RBC Capital Markets has joined Intercontinental Exchange (ICE) Clear Credit as a futures commission merchant (FCM). RBC becomes the first FCM participant at ICE...

TP ICAP connects dealers to Liquidnet’s New Issue Trading protocol

TP ICAP, the interdealer broker, market infrastructure and information provider, is enabling dealers to join the buy-side in placing orders and trade directly on...

Opening the black box: SOLVE’s new AI claims to predict ‘next-trade’ bond prices

SOLVE, provider of pre-trade quotes data across fixed income markets, has rolled out an artificial intelligence platform (AI) that is designed to predict the...

Fixed income is Nasdaq’s greatest challenge

By Flora McFarlane.

Market operator Nasdaq has reported second quarter revenues from fixed income, commodities and currency (FICC) remained at US$19 million from Q1 2017,...

The greatest surprises in bond trading of the last decade

The DESK asked interviewees from its ‘On The DESK’ profile interviews of the last ten years to assess the most surprising changes they had...

Lars Salmon: On internal strength

Fidelity International has homegrown internal expertise and tech, to support a fixed income trading team that can weather all markets.

Lars Salmon is head of...

IMTC launches new, streamlined platform

Fixed income technology specialist, IMTC, has launched a new and improved platform designed to enable fixed income investment managers to improve the accuracy and...

Coalition: Banks’ FICC trading victory in 2020 through remote working and market volatility

Remote working did not hold back sell-side firms in 2020 according to data from analyst firm Coalition. Full year investment banking revenues increased by...

Schroders’ former head traders return to senior roles

Rob McGrath, former global head of trading at Schroders, and Nick Robinson, former head of trading for Fixed Income and Active FX at Schroders,...

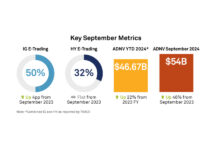

September: US corporate bond ADNV hits $54bn, up 46% YoY

The average daily notional volume (ADNV) for US corporate bonds hit a new high of US$54 billion in September 2024, a 46% increase compared...

BondDroid AI now available within TS Imagine’s TradeSmart fixed income EMS

TS Imagine has made 7 Chord’s BondDroid AI available within the TradeSmart fixed income EMS.

BondDroid AI applies real-time continuous learning technology to generate accurate...

Barclays survey finds half of clients trade 90% of rates tickets electronically

Barclays’ Market Structure team has released its third annual survey of bond market electronic trading for buy-side clients.

In rates markets, when asked what...