Vanguard and BlackRock get stuck into active bond funds following ‘horror show’ in 2022

In a new paper entitled ‘Active Fixed Income Perspectives Q3 2022: Bonds are back’ the fixed income team at investment giant Vanguard, led by...

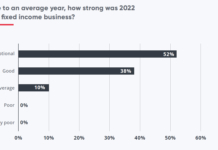

Dealers had ‘exceptional’ 2022 for fixed income; JP Morgan tops Q1 DCM winners

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income...

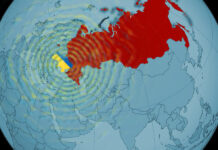

Market disruption spreads beyond Ukraine and Russia

Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering...

People moves: Tumasz joins Oaktree; Trumid poaches Swaby; RBC expands DCM team

Erik Tumasz has joined Oaktree Capital Management as managing director and head of investment and trading technology.

Tumasz is well respected in buy-side circles for...

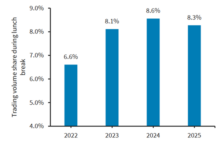

Insights & Analysis: Technology upends traditional credit trading liquidity patterns, Barclays says

In a recent research note Zornitsa Todorova, head of FICC research at Barclays contends that with over half of IG volumes now electronic, systematic...

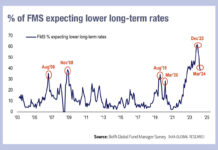

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who...

MarketAxess adds directional and currency functionality to portfolio trading

Bond market operator MarketAxess has added new portfolio trading functionality to its platform, to better integrate with a full suite of trading solutions.

The MarketAxess...

Banks buy into LSEG’s Post Trade Solutions

Banks using LSEG’s post-trade solutions have taken a 20% stake in the business, paying £170 million for the shares.

The transaction is expected to close...

Tradeweb connects repo and IRS markets in electronic workflow

Multi-asset market operator, Tradeweb has launched features that bridge the firm’s repurchase agreements (repo) and interest rate swap (IRS) product offerings to support clients’...

Retail investors add £125m to UK T-Bill market

Opening UK Treasury Bills to retail investors has introduced £125 million of investor capital into the market, according to PrimaryBid.

The capital markets technology platform...

MiFID II has fallen short on transparency say traders

MiFID II has fallen short on transparency and will potentially create tiered access to market information, says Juan Landazabal, global head of fixed income...

Doing more with less: TS Imagine launches best execution compliance module

TS Imagine, a cross-asset provider of real-time trading, portfolio and risk management solutions, has rolled out a module within TradeSmart OEMS and TS One...