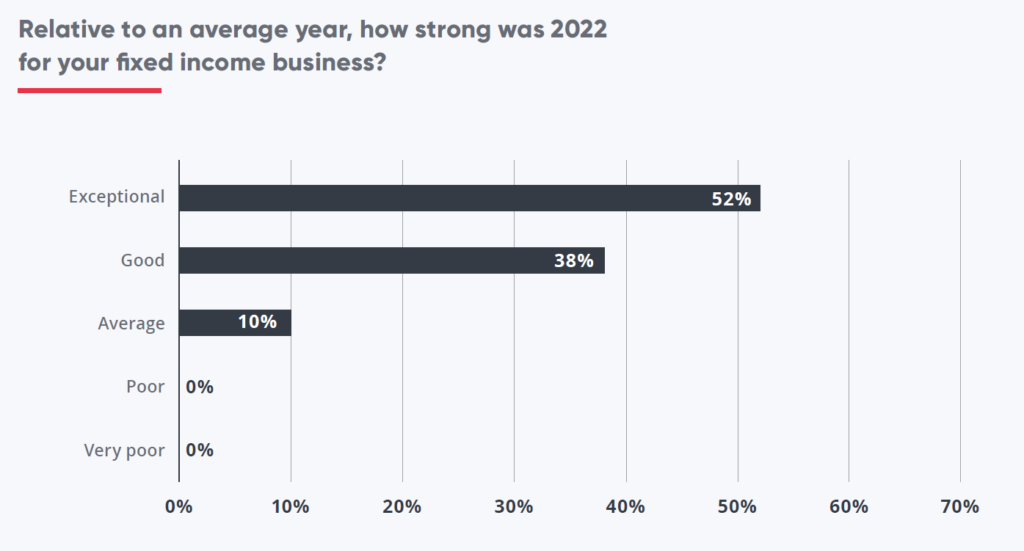

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income trading in 2022.

“Bank of America’s FICC division recently reported year-on-year revenue growth of 49%, taking in US$2.3bn during the fourth quarter of last year. It took the division’s full year revenue to its highest level since 2010. Similar success was posted by JP Morgan and Goldman Sachs’ FICC units, which reported 12% and 44% revenue growth (to US$3.7bn and US$2.7bn), respectively.”

The report, introduced by Joachim Lauterbach CEO of valantic FSA, and Andy Browning, head of electronic trading, found, “Citigroup‘s and Morgan Stanley’s fixed income revenues grew by 31% (to US$3.2bn) and 15% (to US$1.4bn). Jefferies saw a 71% surge in its bond trading revenue. The success of the tier one bond trading shops was reflected across the sell-side, with sentiment buoyant in the fixed income network … over a third said it had been good and none said poor or very poor.”

Eighty eight percent of respondents attributed their growth to market conditions.

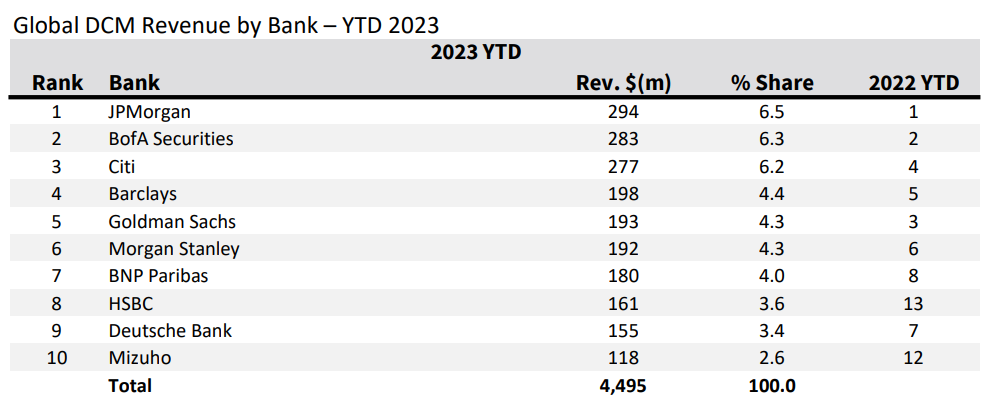

Dealogic’s league tables for the first quarter of 2023 have shown that JP Morgan, Bank of America Securities and Citi took the top three spots for revenue in debt capital markets, albeit with a close share of market – 6.5%, 6.3% and 6.2% – with a significant drop of at fourth place, held by Barclays, with 4.4%.