S&P to end TCA offering

S&P Global is shuttering its transaction cost analysis (TCA) operations, according to sources familiar with the matter.

Michael Richter, EMEA executive director of TCA at...

ESMA launches consultation to clarify boundaries of trading venues under MiFID II

The European and Securities Market Authority (ESMA) has launched a consultation on what constitutes a trading venue, and what can be considered a trading...

The $21.6 trillion question: How many regulators does it take to change a lightbulb?

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...

How a credit sell-off might unfold…

Someone, somewhere, is cooking the books

In 2007, I explained the risks of cumulative capital market investments to a friend as a series of interconnected...

How is e-trading accelerating the momentum for global Emerging Markets?

Despite persistent macroeconomic challenges, EM bonds have achieved broad gains in 2024.

Traders are increasingly on the lookout for tools that can help them...

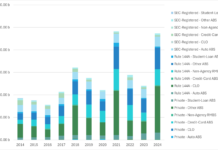

Insights & Analysis: SEC new datasets show 2024 was a boom year for ABS

New regulatory data published by the Securities and Exchange Commission’s (SEC) Division of Economic and Risk Analysis shows US asset-backed securities issuance almost doubling...

FILS 2022: FlexTrade, Glimpse herald “transformative” EMS data integration

Bond market data sharing platform Glimpse Markets has integrated with FlexTrade Systems’ fixed income execution management system (EMS), the two companies have announced.

FlexTrade said...

Major firms rally around software standardisation

Major firms rally around software standardisation

The new OpenFin operating system, designed for use in finance houses, has gained considerable support for an initiative to...

Credit trading desks seeing job cuts & hiring freezes, adding to operational pressure

Reports of reduction in headcount on buy-side trading desks at BlackRock, Nuveen and Wellington with cuts also reported at investment banks, are demonstrating the...

Bloomberg facilitates European government bonds electronic list trade

Bloomberg has executed the first electronic list trade in European government bonds though its multilateral trading facility (MTF), with its evaluated pricing service (BVAL)...

TT International picks Jean-Charles Sambor to lead EM debt team

TT International has appointed Jean-Charles Sambor as head of its emerging markets debt division. The group will run EM debt strategies across sovereign and...

Direct price streaming will transform credit trading

Banks are providing corporate bond pricing feeds direct to clients shaping new potential execution paths. Dan Barnes reports.

Big investment banks including Morgan Stanley, UBS...