New Aité report provides detailed analysis of fixed income EMS capabilities

A new report from the Aité Group, penned by Audrey Blater and Matt Simon, has provided an in-depth look at the execution management system...

Invesco’s AT1 bond ETF has “opened door to large investors” as AUM passes US$1...

The Invesco AT1 Capital Bond UCITS ETF has surpassed US$1 billion in assets under management, (AUM) with around US$500 million of net new assets...

Christine Kenny announces retirement

Christine Kenny, strategic project leader and Loomis, Sayles & Company and a board member for Natixis International Funds has announced her retirement after nearly...

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

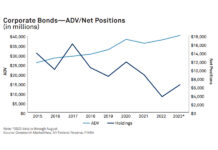

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...

B2Scan closes down

B2Scan, the pre-trade liquidity data platform for bond markets, has shut down after eight years. The CEO and founder of B2Scan, Frédéric Semour, was...

Kluth named head of dealing at AMP Capital

Dylan Kluth has been promoted to head of dealing at AMP Capital, seven years after taking up his first trading role as an equity...

Raj Paranandi resigns from MarketAxess

European and APAC chief operating officer Raj Paranandi is leaving MarketAxess for an external role, the company has confirmed.

Paranandi has been in the role...

MeTheMoneyShow – Episode 22

Dan Barnes speaks with Lynn Strongin Dodds about some old chestnuts - a consolidated tape for European equities, and the implications of Brexit for...

Connecting the Dots of Innovation – A Breakthrough in All-To-All Trading

By Iseult E.A. Conlin, CFA

Managing Director, U.S. Cash Credit, Tradeweb.

In the wake of the 2008 financial crisis, the majority of the US fixed income...

MarketAxess hit 21.5% of investment grade TRACE volume in Q2

Fixed-income market and infrastructure operator, MarketAxess, has seen revenues for the second quarter of 2020 increase 47% year-on-year (YoY) to US$184.8 million, up from...

Meraki Global Advisors hires fixed income trader from Loomis, Sayles, & Company

Meraki Global Advisors has hired Meghan Siripurapu as a managing director at the firm’s Park City Headquarters in the USA, to meet the growing...

Bloomberg backs Moroccan FX and govie market buildouts

The central bank of Morocco, Bank Al-Maghrib, has adopted Bloomberg’s Foreign Exchange Electronic Trading (FXGO) and E-bond (EBND) platforms.

The interbank derivatives market for foreign...