FILS 2021: Next steps to automating the bond market

Data analysis, interoperability and flexibility are the top priorities for automating the bond markets, delegates at the 2021 Fixed Income Leaders Summit (FILS) in...

Sabina Awan joins Rokos Capital Management

Sabina Awan has joined Rokos Capital Management as a trading solutions consultant.

The London-based alternative investment fund manager covers global macro asset classes and holds...

FILS USA: Growing disparity in liquidity ‘haves’ and ‘have-nots’

Panellists at this year’s Fixed Income Leaders Summit agreed that industry collaboration, experimentation and greater competition are needed to improve liquidity across the fixed...

Rock Springs Capital appoints T Rowe’s Williams as head of trading

Clive Williams, who led equity trading at T Rowe Price for nearly two decades, has been appointed head of trading at Rock Springs Capital...

US corporate bond market continues upward trajectory

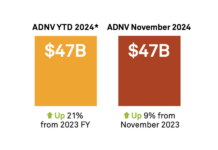

Average daily notional volumes (ADNV) were up 9% year-on-year (YoY) in US credit markets, reaching US$47 billion. Year-to-date, ADNV is up 21%.

In 2024, the...

Seth Merrin stands down

Seth Merrin is to stand down as chief executive of Liquidnet, the US broker he founded almost 20 years ago. He will remain as...

James Wallin: On valuing the desk

Proving and demonstrating the value of the trading desk at the very highest levels of the organisation creates a virtuous circle of investment and...

HSBC splits

An organisational switch-up at HSBC, effective 2025, sees the bank prioritise its Hong Kong and UK operations with dedicated business lines.

HSBC Holdings will operate...

The Fixed Income Leaders Summit: Debating a decade of change

The focused event delivered a communication hub that has supported the buy and sell side as they navigated market transformation.

“In 2014, this event was...

Bank of England warns of risks in fast fixed income markets

By TheDESK

Chris Salmon, executive director for markets at the Bank of England has warned that risk management techniques need to develop to handle the...

Case study: Russell Investments in Search of Liquidity – Open Trading

As a top provider of Execution and Transition Management Service, Russell Investments understands the importance of leveraging cutting-edge tools for best execution.

Read more...

Re-designing the fixed income landscape

Benjamin Bécar, Fixed Income Product Manager at smartTrade Technologies believes that growing access to data is enabling buy-side firms to transform their trading workflow...